The 2Miners pool experts share their thoughts in a simple and clear manner. The article is mainly for those who activated mining rigs that work and bring money. We don’t use complicated terms like “gas”, “Gwei”, etc. With that being said, even professional miners will gain a lot of value from this article.

Contents

Gas Price in Ethereum Network. Payout/Transaction Issues

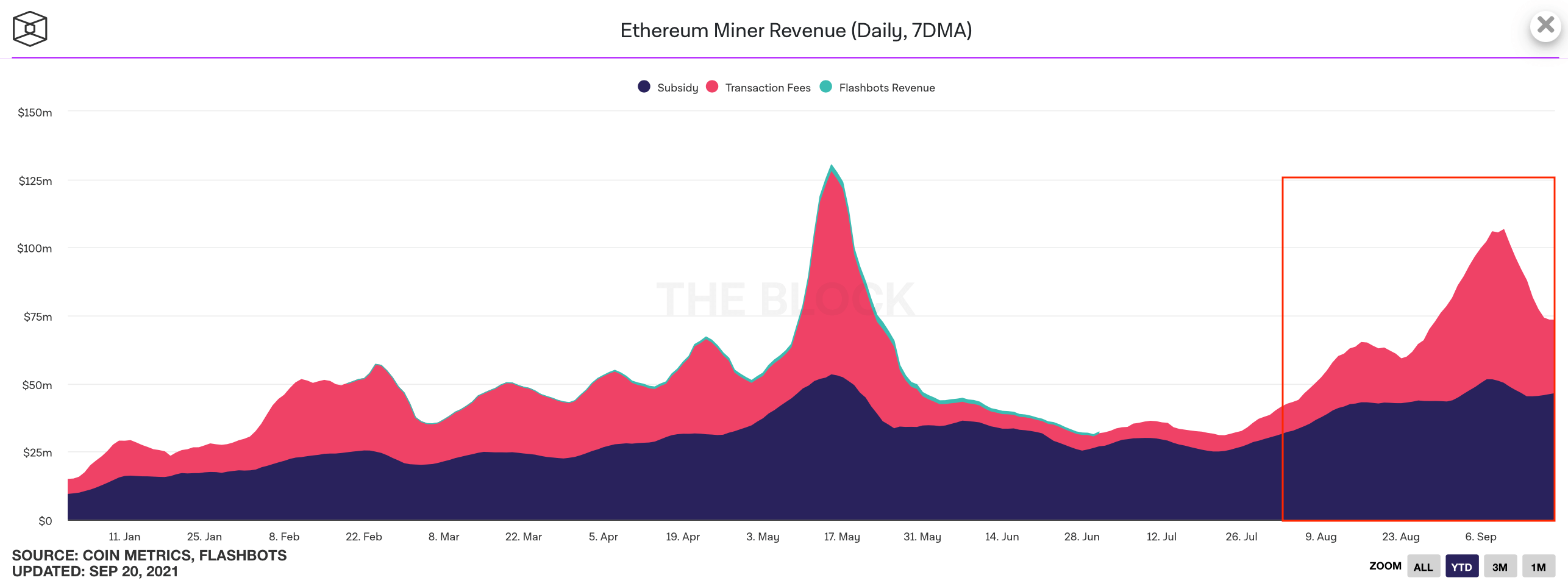

At the beginning of August, the Ethereum network got updated. As a result, some part of ETH that used to go to miners is being burnt now disappearing from the network forever. Another change is that pools can no longer include any transactions they want in their block. Before the update, pools could issue payouts to their miners while paying the minimum fee, but this is not an option anymore.

More on the topic: Ethereum London Hardfork – What Does EIP-1559 Change?

We already discussed many times how it affected mining profits, and we keep discussing it daily in our Telegram chat.

Simply put:

- Miners started earning more. Even though profits in ETH fell, the cryptocurrency exchange rate grew significantly. As a result, the overall profitability in US dollars increased.

- Pool payouts are now held at the expense of miners.

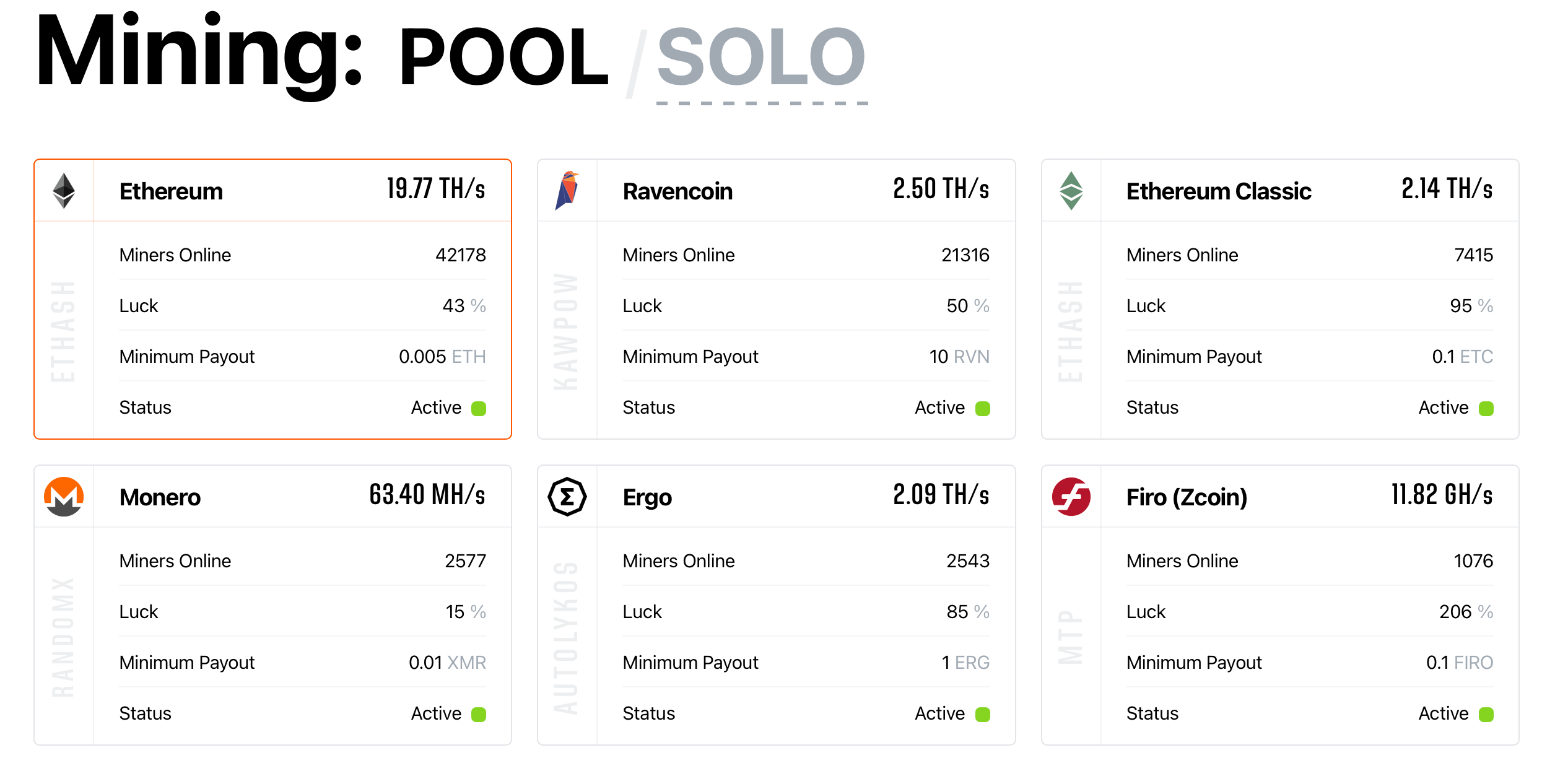

The payout issue turned out more complicated than everybody thought. Pools have to take care of all miners at the same time, but they want different things. Some want to get the reward asap and are ready to pay anything for it, others prefer to wait and avoid high fees.

The problem seems easy to solve, but it’s not. A pool has only one wallet. All transactions with the Ethereum network go through it. Pool rewards come to this wallet, and the pool then pays to miners from this same wallet. The Ethereum network operates in such a way that transactions from one wallet must go in a strict order, one after another. No exception.

What does it mean? The pool can’t give miners the possibility to choose the fee amount during payout. Say, Jack is one of those who don’t want to pay high fees. He set the fee as low as possible and is waiting for the Ethereum transaction fee to go down. He can wait for an hour, two hours, a day, or a week. Other pool miners are waiting too. Until Jack, who is 3rd in line, gets his payout, the pool can’t send any other payout to the 4th, 5th, 6th, etc.

What happens then? Clearly, other miners get annoyed with Jack. Best case scenario, they wait for their turn despite the annoyance, worst case scenario, they leave the pool forever. We surely don’t want that, so we have to come up with a solution. As of now, payouts are set in such a way that miners pay no more than $5.

Please note that if you use an exchange address, payouts may cost you more. Some exchanges use smart contract addresses instead of regular ones, and payouts to such addresses require more gas. As a result, the fee is higher. We recommend using direct Ethereum addresses. It's worth pointing out that not all exchanges use contract addresses. You can check it here.

What should Jack do if he is not happy with the high fee? The only thing he can do now is to adjust the payout threshold every time. Say, he has 0.021 ETH. In this case, he should make the threshold higher, for example, 1 ETH. This way the payout won’t come through. He should wait until fees in the Ethereum network decrease. Then he can set the payout threshold under 0.02 ETH, making it lower than his available balance so that the payout can come through.

Jack might say: “What a pain!” And he would be right. Whose fault is this? We think Ethereum developers are the first to blame. They broke the system that had been working for years. But hey, they are developers, hopefully they know better.

How do we adapt? At the moment, we are working on the smart payout system that is supposed to satisfy all miners. The release date is not set yet, but we hope to roll it out in a month or two.

Will ETH Shift to POS This Year?

“I’ve read that Ether mining will be dead by December”, “They say POS is already ready”, “And I saw …” That’s what we hear every single day. Honestly, nobody knows when Ethereum mining ends. Here is what we think.

Ethereum has been shifting to POS for years now. Beginning miners are terrified by rumors around Ethereum all the time. Nothing has really changed since then. Of course, there is some progress but nobody knows when the shift is going to happen. Think about AMD, Nvidia, and other companies that sell mining equipment. Do you really think they will simply give up a significant part of their income? Unlikely.

Also, remember that the developers are planning to launch some sort of a hybrid system combining POS and mining first.

Again, we don’t know the exact launch date. However, we believe that Ether mining will not end in 2022.

You might ask then: “Should I buy graphics cards?”

Well, that’s a tough question. The cryptocurrency world is highly volatile. Exchange rates fluctuate, mining difficulty changes. The only thing we can do is to give advice.

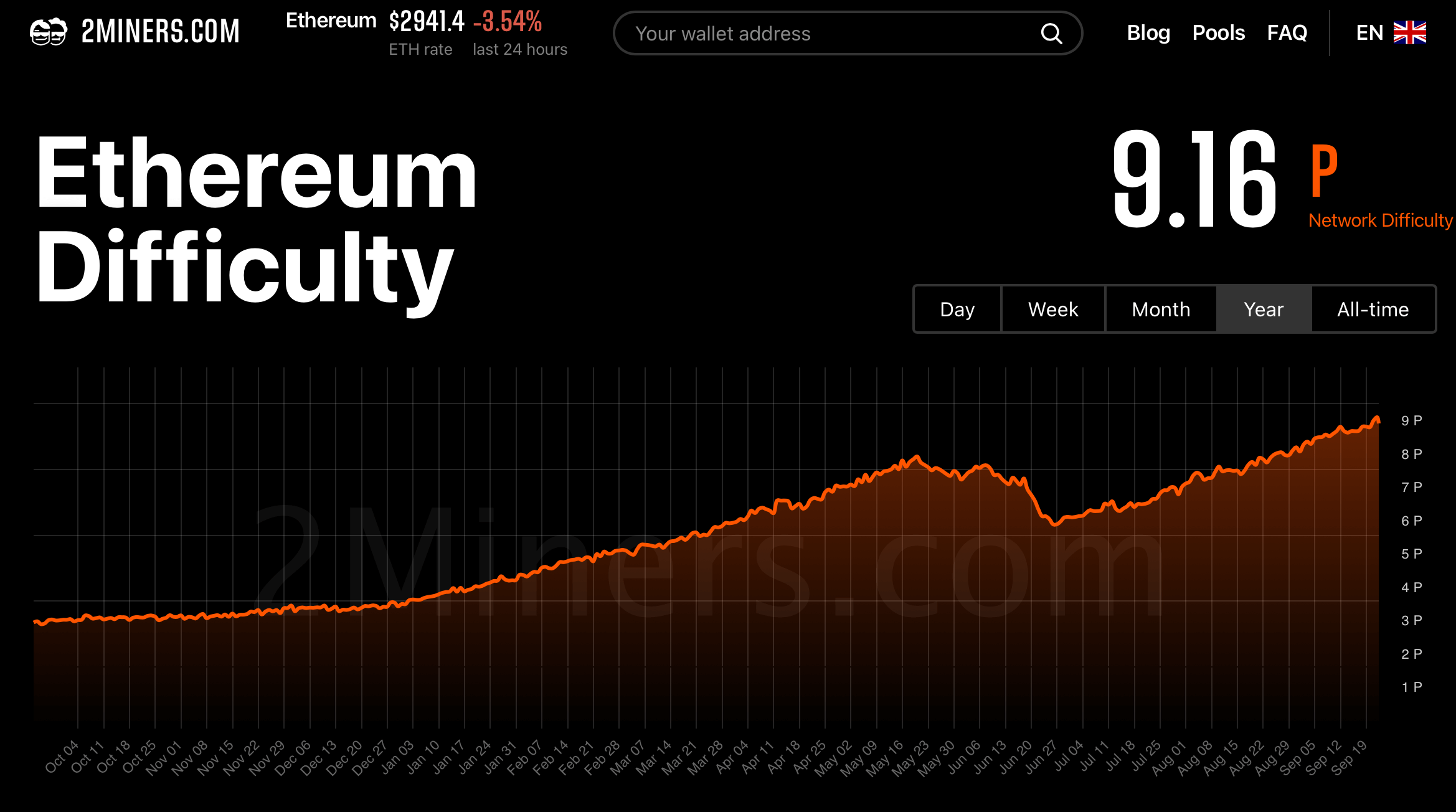

Ethereum is mined on GPUs. If about 30 million GPUs around the world are mining Ether right now, what could change in a year? Let’s say, all old suitable GPUs are already mining. Nvidia and AMD production capacity is limited. They can’t build a billion new graphics cards in a year. How much can they produce?

Hard to say. Try looking for their reports. From what we saw, Nvidia can produce about 40 million chips in a quarter. How many of them can be allocated for mining? Apart from mining, there is also gaming, heavy computing.

Look at the Ethereum difficulty chart. If the price doesn’t fall, the difficulty can grow twice in the next year.

Guessing the exchange rate is not really worth it. So it’s up to you.

Use 2CryptoCalc to calculate profitability, think about how it might change. What is the depreciation value of a graphics card? If mining dies or profitability plummets, how much can you expect from selling it? Think about all these questions before you make a decision. We surely discourage you from getting a loan or spending your last money to start mining.

Ethereum Difficulty Bomb Postponed Till December

The “Difficulty Bomb” also called the “Ice Age” was developed a long ago in 2015. The idea of the Ice Age process is to gradually increase the mining difficulty and therefore block time in Ethereum Network which is currently a little higher than 13 seconds and it remains fixed.

Obviously, the Difficulty Bomb is bad for miners as they start getting fewer rewards. After activation, Ethereum block time will grow five times in 5 months. Therefore miners are expected to get 5 times fewer rewards.

The Ice Age has been already delayed multiple times: in 2017, 2019, 2020, and 2021. The recent EIP-3554 postponed the Bomb until the first week of December 2021. Does it mean that this was the last time Ethereum developers put this idea on hold? Absolutely not! Most likely the Ice Age would be postponed again or maybe even removed in the future. Currently, the Ethereum gas prices could be very high. Could you imagine the gas price growth while there would be fewer blocks each minute and fewer places for the users’ transactions?

What happens when Ethereum shifts to POS?

In brief, POS will put an end to ETH mining on GPUs. What will happen to miners? Nothing good. Only 10% of GPUs in the World mine other cryptocurrencies, while 90% mine ETH. Now imagine that ETH mining gets deactivated. Everyone will start mining other cryptocurrencies. Mining profitability will be 10x lower. Will mining be profitable then? Unlikely.

But if someone asked you whether 1 ETH could cost $30 thousand or whether 1 BTC could cost $500 thousand, what would you say? If you’d say yes, then mining might survive. If all cryptocurrencies skyrocket, mining will still be profitable, even after ETH shifts to POS.

We hear a lot of theories about the increase in price of such coins as RVN or ERGO after all ETH miners shift to them. We think it’s wrong. There is no connection here. The number of miners doesn’t affect the price at all, be it 10 or 20 thousand people.

Remember to join our Telegram chat and follow us on Twitter to get all the news as soon as possible.