Contents

Bitcoin vs Ethereum. Decentralization

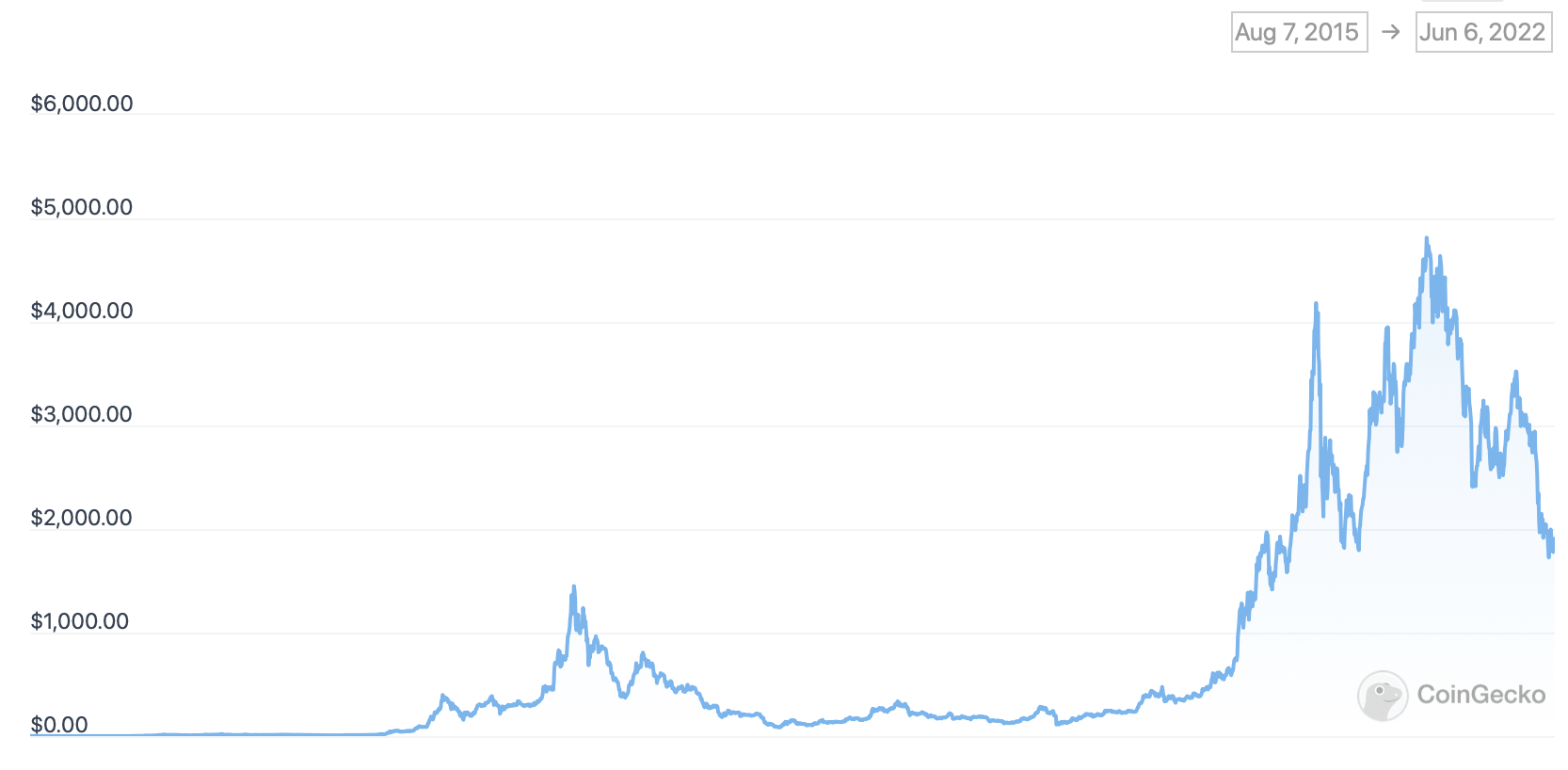

Cryptocurrencies come and go, rise and fall, but there are two cryptocurrencies that have always stayed at the top for many years: Bitcoin (BTC) and Ethereum (ETH). Everyone compares these cryptocurrencies all the time.

Bitcoin

Bitcoin is the world’s first cryptocurrency, the father and mother of all other coins. Without BTC, other coins wouldn’t have existed. Bitcoin is the “digital gold”, the most secure coin, the keystone of all. It’s spread all over the globe. Bitcoin’s old software versions work great with its new versions.

The Bitcoin network has had only a few updates lately, but the truth is, it doesn’t need many. It’s good the way it is. Anyone in the world can become a Bitcoin user and launch a fully functional Bitcoin node. You only need a computer connected to the Internet and 400 GB of free space on the hard drive.

Of course you can also download a light wallet on your smartphone, but in this case, it's going to use the wallet's developer node.

The Bitcoin network is used to transfer BTC between users. Make sure to read our detailed guide about Bitcoin: What Is Bitcoin in Simple Terms: From Theory To Practice.

Ethereum

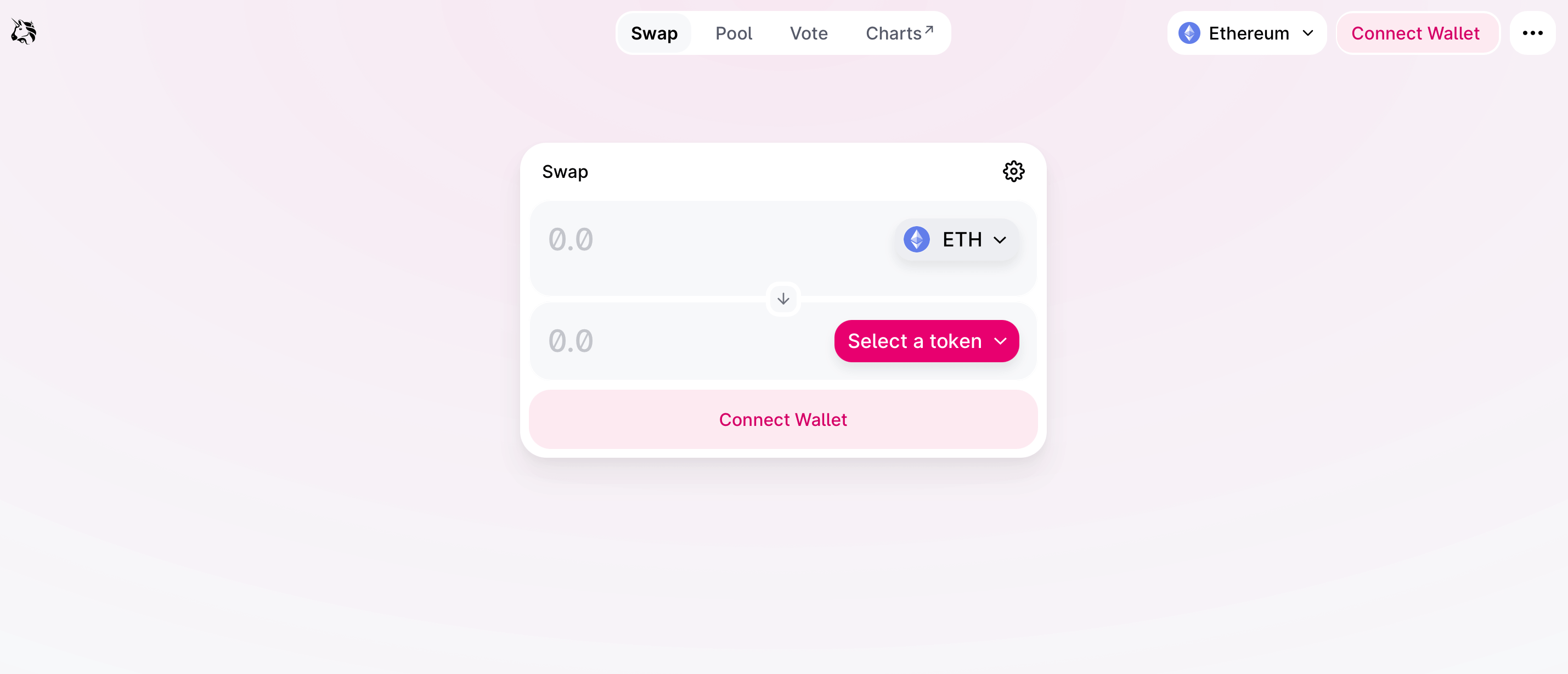

Ethereum is a unique project developed on the base of Bitcoin. It’s not just a digital currency, but also a platform for the creation of blockchain-based applications. The Ethereum network allows you to transfer ETH coins that have value, but you can also launch programs called smart contracts inside the network.

Ethereum is like a botnet that allows you to launch a program on all computers within the network. Unlike a botnet though, Ethereum programs can’t access the external Internet and can’t harm anyone. In recent years, we’ve seen some unique projects developed on the Ethereum platform, like decentralized exchanges and other DeFi projects. They are trading platforms operating based on the preset algorithm without any human control or participation.

Ethereum is regularly updated. According to Electric Capital, over 4,000 developers are working on the project. One of the updates is the introduction of a smart contract for Ethereum staking that already stores over 10% of all ETH. Another important update is mining fee burning in the ETH network.

There is a lot going on with the project, and probably that is why users don't criticize the developers for the lack of an official and user-friendly wallet. There are a lot of wallets for Ethereum, but they are all third-party wallets.

Are Cryptocurrencies Decentralized?

You probably already know that cryptocurrencies are decentralized. No one runs them, there is no system in place to override, return transactions or direct them to a different address, you can’t delete your address, etc.

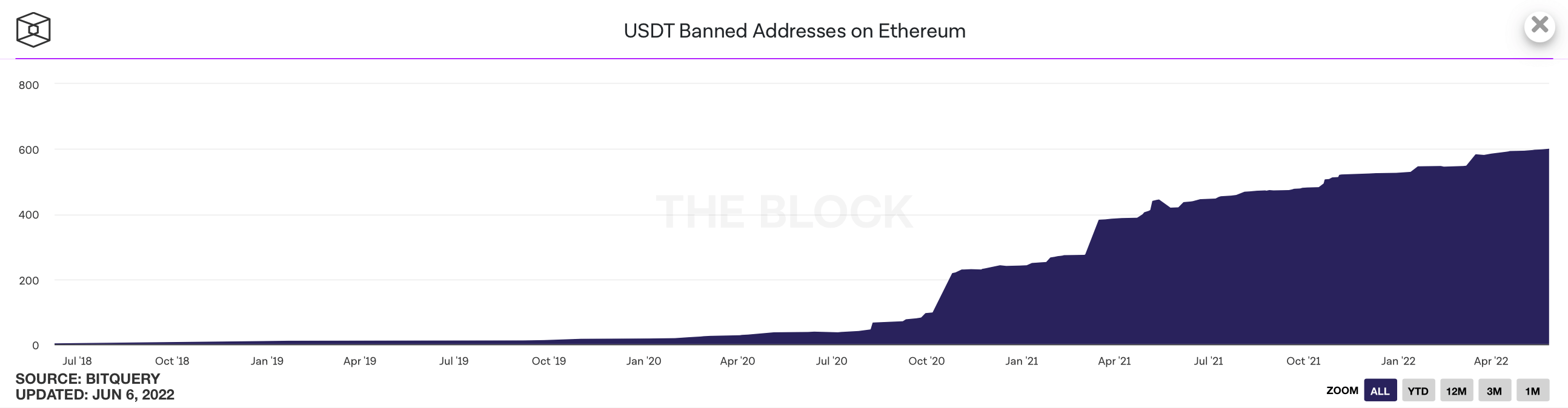

You can freeze your address, but not fully. For example, the Tether company that created the most popular stablecoin called USDT can prevent certain addresses in the Ethereum network from interacting with it. As of now, there are 597 addresses on the blacklist. But you can easily create a new address thus bypassing the ban.

Say, if you send the cryptocurrency to someone’s address, there is no way to get it back. At the same time, if you store the cryptocurrency on your personal wallet, tax or other authorities don’t have access to your funds. Everything is in your hands.

However, not all people understand what makes decentralization possible.

If you install a Bitcoin wallet on your computer with a full blockchain copy keeping it connected to the network, will you contribute to decentralization? Yes and no. But mostly you won’t. All network nodes are interconnected and transmit information about new blocks to each other. Your node also validates new blocks in the network. So your node helps to spread information faster among other network nodes, but it doesn’t help with anything else.

Decentralization is mostly made possible by miners, or by those nodes in the network that not only transmit and receive information but also find new blocks. Miners are the ones responsible for filling blocks with new transactions. We wrote about it in the article: What Is Mining?

Decentralization is Ethereum’s key advantage over Bitcoin and all other cryptocurrencies. Vitalik Buterin has created a unique solution that no one has been able to replicate yet. Why is it so unique?

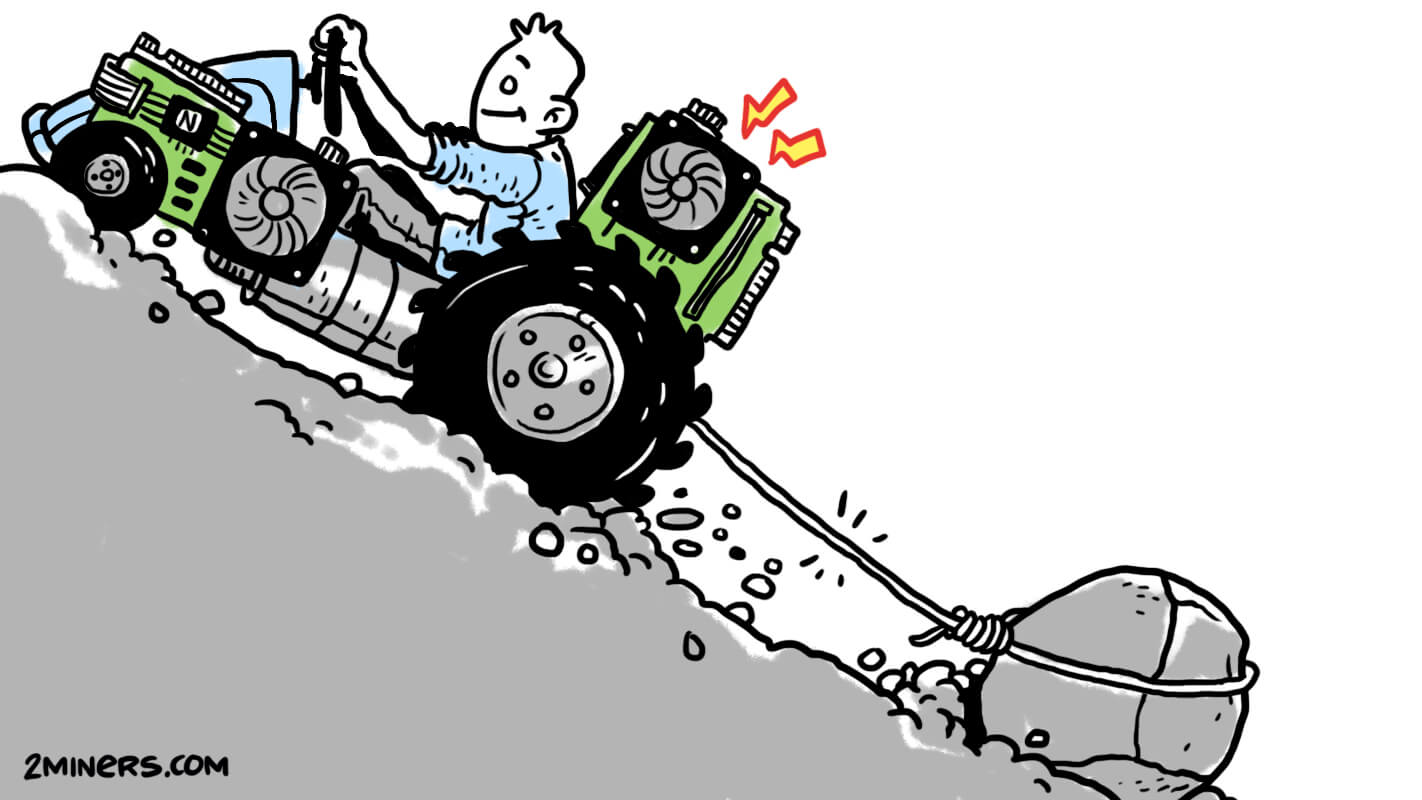

If you want to mine most cryptocurrencies, you need special equipment. Bitcoin and many other coins are mined using the so-called ASIC devices. They are metal boxes with electronic circuit boards and extremely noisy fans that are actively blowing out the air. They are impossible to use at home and require a dedicated space.

There are no ASIC miners for Ethereum mining. That is, there are devices called in such a way, but in reality, they are just multiple GPU chips placed in the same case. Such ASICs are not superior to normal GPUs in any way. Their performance is at the same level, while the price is often higher. Plus, GPUs are multifunctional: you can use them to mine, render objects in 3ds Max, and play GTA5. ASICs for ETH are designed exclusively for mining, and their repairability is close to zero.

Ethereum Is the Most Decentralized Currency. Yet

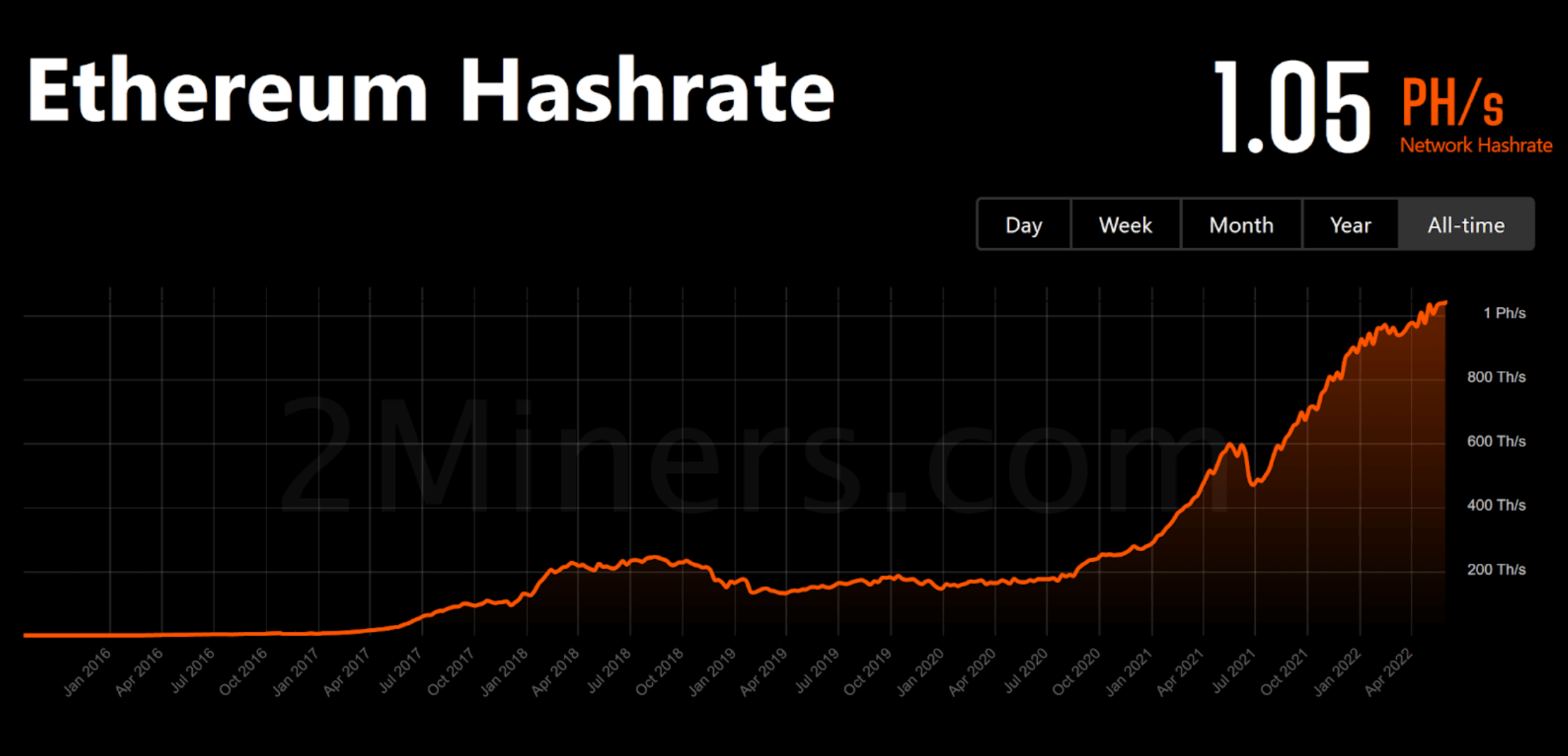

Unlike Bitcoin, Ethereum can be mined only with GPUs. Thanks to its mining algorithm security, no one has been able to develop ASICs.

GPUs are available everywhere, so there are ETH miners all over the world. Some mine with one GPU, others mine with two, and there are those who have a garage full of GPUs. The point is, that everyone can start mining. And you don’t need much to do so. With a computer at home and $200–$300 to spend, you can already start mining.

How many GPUs are mining Ethereum? At a current network hash rate of 1.05 PH/s and an average GPU hash rate of 40 MH/s, over 25 million GPUs mine Ethereum across the globe. Some other cryptocurrencies are also mined with GPUs, but even the most popular ones are mined by less than a million graphics cards. The difference is huge.

Bitcoin mining is only possible in special locations, like factories, industrial sites, etc. One up-to-date ASIC mining device costs a few thousand dollars. Plus, you need low electricity rates to be able to afford to mine. It’s hard to say how many people mine Bitcoin in specific countries, but it’s no secret that the leading countries are the USA, Russia, Kazakhstan, and China, despite the official ban on mining. A common person can’t mine Bitcoin. There is a workaround, but even in this case you actually mine ETH and then get paid in BTC.

Ethereum is much more decentralized than Bitcoin. Ethereum truly belongs to people. This is mind-blowing.

Ethereum developers though want to “centralize” the coin. They want to give control over Ethereum to rich users, those who have a lot of ETH. It means that a group of rich people will define the consensus in the network. You may think that they wouldn’t have any interest in harming the coin in any way because they invested a considerable amount of funds in it. The truth is, by working together they can alter the network operation to increase their profit.

Ethereum Staking. What Will Change after the Shift to POS?

Simply put, POW is mining, while POS is staking. Mining means using your computing powers to get rewarded. Staking means locking a certain amount of money on your account and keeping your wallet online to get rewarded.

To become a true validator of the Ethereum network after it shifts to POS, you need to lock 32 ETH, which is sixty-five thousand dollars at the current exchange rate. What are the consequences of quitting mining and shifting to staking? Let’s talk about the key ones.

Lack of Decentralization

As we mentioned above, Ethereum is the most decentralized cryptocurrency of our time. GPUs are widely spread all over the world. Plus, you need only $200–$300 to start mining. After the shift to POS, you’ll need much more investments to start staking: in order to get a reward, you’ll have to lock the equivalent of $65 000 on your account, not to mention the expenses of powering your computer and renting a server for your validator node.

If Ethereum shifts to POS, it will no longer be the most decentralized currency in the world. It will become just an ordinary coin with a network security level comparable to many other coins.

Colossal Risks of Stakers

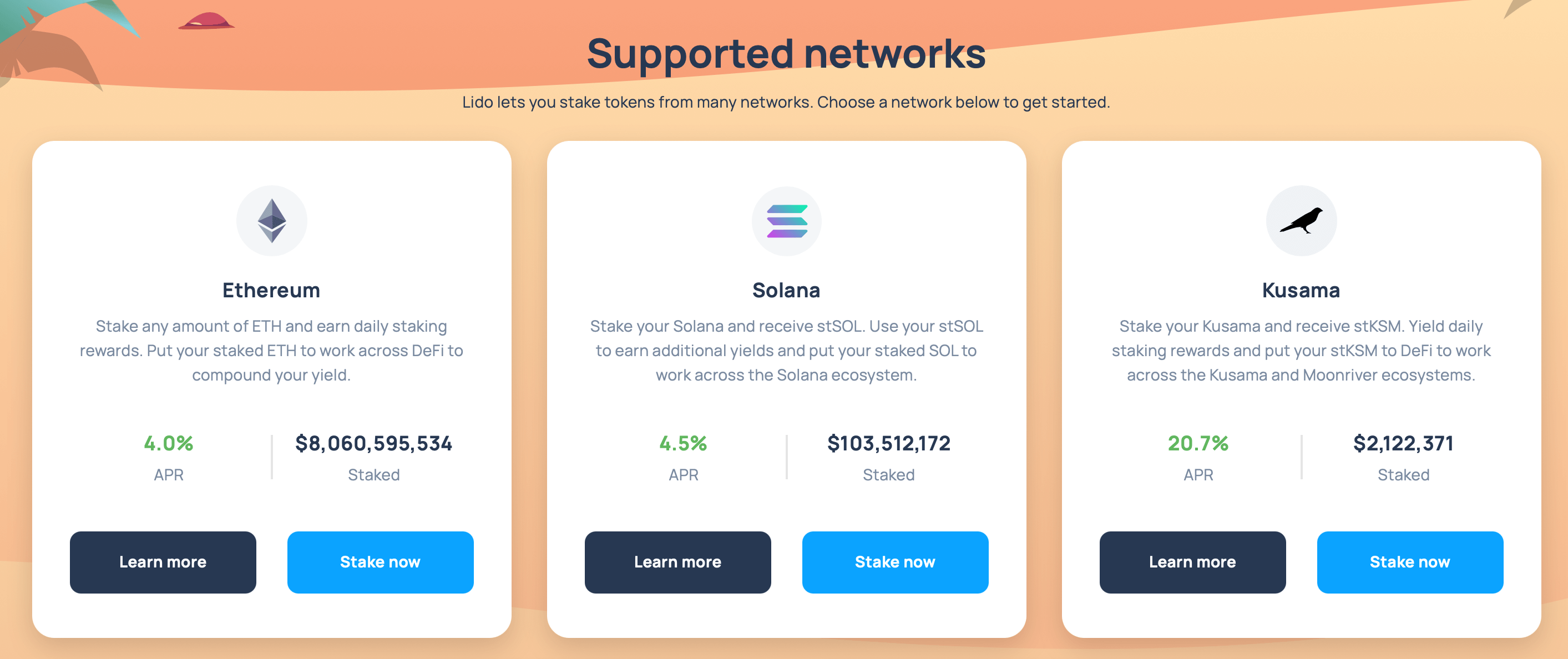

Some might argue that you don’t necessarily need 32 ETH to start staking: you can stake in pools, plus many exchanges will launch their own validators, etc.

Sure, you can stake in pools, as well as give your money to exchanges, but keep in mind the key rule of cryptocurrencies: Not Your Keys, Not Your Coins. You could pool 32 ETH with 31 more people by sending 1 ETH each to some platform that would launch a validator for you.

But how can you make sure that such a platform won’t rip you off? Someone could also hack the platform and steal your money. It’s even worse with exchanges: almost all of them have been hacked at least once, and the rest could be hacked at some point. Plus, exchanges tend to change KYC policies quite often. If you fail to comply one day, you won’t get your money back.

Exchanges can also ban user accounts due to "suspicious activity" without any further explanation.

Even if you have 32 ETH and you managed to launch your own validator node, it doesn’t mean that you will now get generously rewarded. There are a lot of penalties that your validator can get. You will be charged for all of them, as well as for inactivity.

Imagine that your validator gets under a DDOS attack. In this case, you will be charged a penalty. If someone launches a virus and your validator gets affected, it will be sending the wrong data to the network. The base penalty for such an error is 0.25 ETH, or $500.

In mining, these types of problems don’t exist. You get a reward without running any risks. No one can confiscate your GPUs if they don’t operate properly. Plus, you need $200–$300 to start mining, not $65 000. Mining is mostly done through mining pools. If something happens to a pool, you can switch to another pool in no time. In the case of staking, you can’t do that, especially if you stake through a third-party platform. Moreover, the servers of such a platform may catch fire, get seized, and your coins may disappear or get locked at any moment.

The ETH exchange rate tends to fluctuate, and you get as little as 5% per year for staking and run colossal risks.

Also in case of staking, you can’t withdraw your money for now. And it’s still unknown when it will be possible. You also don’t know how much 1 ETH will cost on that day: it can be $400 or $1,000. Nobody knows.

ETH Mining Profitability after the Shift to POS

Miners won’t have any profit, because there will be no Ethereum miners, only Ethereum stakers. But if you compare staking and mining in terms of profitability, the former is 10x less profitable. Read more here: Ethereum Proof of Work (Mining) vs Proof of Stake (Staking) Profitability Comparison.

It means that common users will lose a source of income.

POS Security Is Questionable

Ethereum has been around for seven years now, since June 30, 2015. The network has always used POW as an algorithm, and mining is ensuring network security. It’s a tried and true solution. Ethereum hasn’t experienced any attacks for many years. In order to hold a 51% attack, you need a huge amount of computing power in the form of GPUs that no one in the world has.

The shift to POS and staking raises a lot of questions. Have ETH developers really made sure that their code is valid and the network is secured against any incidents? For example, on May 25, Ethereum’s POS network experienced a 7-block deep reorg. Simply put, the blockchain got split into two chains, so they had to cancel one of them. With mining, Ethereum hasn’t experienced such problems for a few years now.

Does Ethereum Need POS? What’s behind Developers’ Actions?

The Ethereum developers claim that POS is necessary for environmental reasons. Cryptocurrency mining uses a lot of equipment that consumes megawatts of power. But shifting to POS will deprive Ethereum of decentralization.

Plus, only extremely rich people will benefit from Ethereum staking, while common people won't be able to afford it.

The new system will boost the number of fraudulent platforms offering to stake jointly. And their victims will lose money. All of it will ruin trust in cryptocurrencies, and the consequences may be much more serious than the fall of LUNA and UST.

Furthermore, many cryptocurrencies offer staking, but can you name at least one successful project? At the time, Ethereum replicated Bitcoin’s success by taking its best parts and adding new groundbreaking ideas. It was a coin designed for mining. Now, why is Ethereum trying to implement a mediocre idea? Bitcoin and Ethereum come first and second respectively in terms of the cryptocurrency market cap in the world.

POS Risks

We know that the developers have been delaying the shift to POS for 4 years now. Does it mean that they themselves are not so sure about it? How can this fully replace the old fully functional system?

The cryptocurrency market is full of coins with validators, masternodes, and staking. But only Ethereum with its mining is the second most popular coin after Bitcoin.

More than 10% of all ETH coins are now locked in Ethereum’s staking smart contract. What will happen when it becomes possible to withdraw this 10% of all Ethereum coins? It’s more than 12 million ETH, or $24 billion. If you stake 32 ETH now, they get locked, and it’s still uncertain when withdrawals will be enabled. What will happen to the exchange rate when this 10% of coins flood the market? Even if only half of all users start selling these ETH coins, we are still talking about selling billions of dollars worth of ETH.

Why should people even consider ETH staking if the annual interest is only 5%? They’d better buy a property and rent it. You can expect the same profit from renting an apartment. But the cost of an apartment doesn’t fluctuate from $4800 to $1800 within a couple of months. The risks are much lower.

Does it mean that staking will be used for money laundering? Why else would someone invest in such an unprofitable and risky asset?

What if someone invests illegal ETH coins in the same staking pool you’re using? The authorities might start the investigation and put the platform operation on hold or even close the platform. You may lose any control over your coins.

Also, imagine investing 32 ETH at a rate of $4,800 per ETH and discovering in a month that 1 ETH now costs $1,500. We really are clueless as to who may be interested in such business.

Remember to follow us on Twitter to get all the news as soon as possible.