Contents

Mining Is More Popular Than Ever. Cryptocurrencies Conquer the World

I started mining in 2017. I stopped mining in 2020 when exchange rates fell. If you read my first article, you’d know that I was going to use GPUs that I wasn’t able to sell to build a few rigs and heat my country house with them. Those GPUs were completely worn out: 4GB and 8GB RX 580, a few 1050 Ti, and a couple of 1070 Ti cards. I’ve built two rigs that are still heating my small country house in winter. They do the job, but their aspect is extremely embarrassing (see below).

Had I been more inventive, they could have looked like this.

I kept following the 2Miners chat because it is the best channel for mining in Telegram. Crypto prices were going up and down. With each period of growth came a new wave of miners. Sadly, I noticed that many beginning miners are unwilling to dive deep into the subject anymore. People used to hang out on pages like this one to monitor the network, and now they barely understand what a bat file is. Luckily the community still has active expert miners. 2Miners contributors always say that one of the biggest advantages of cryptocurrencies is their transparency. I will try to write in simple terms so that it all makes sense to as many readers as possible.

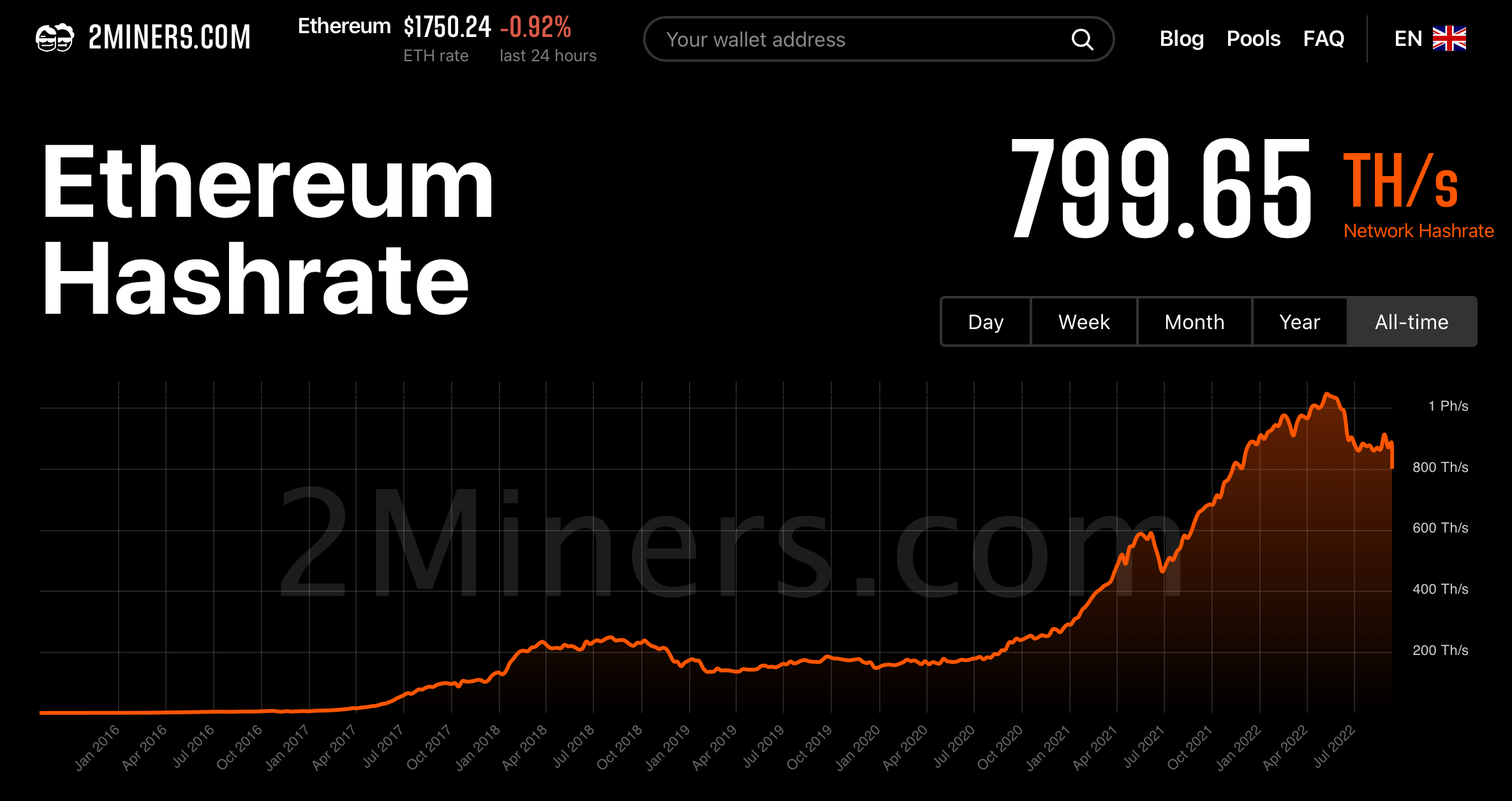

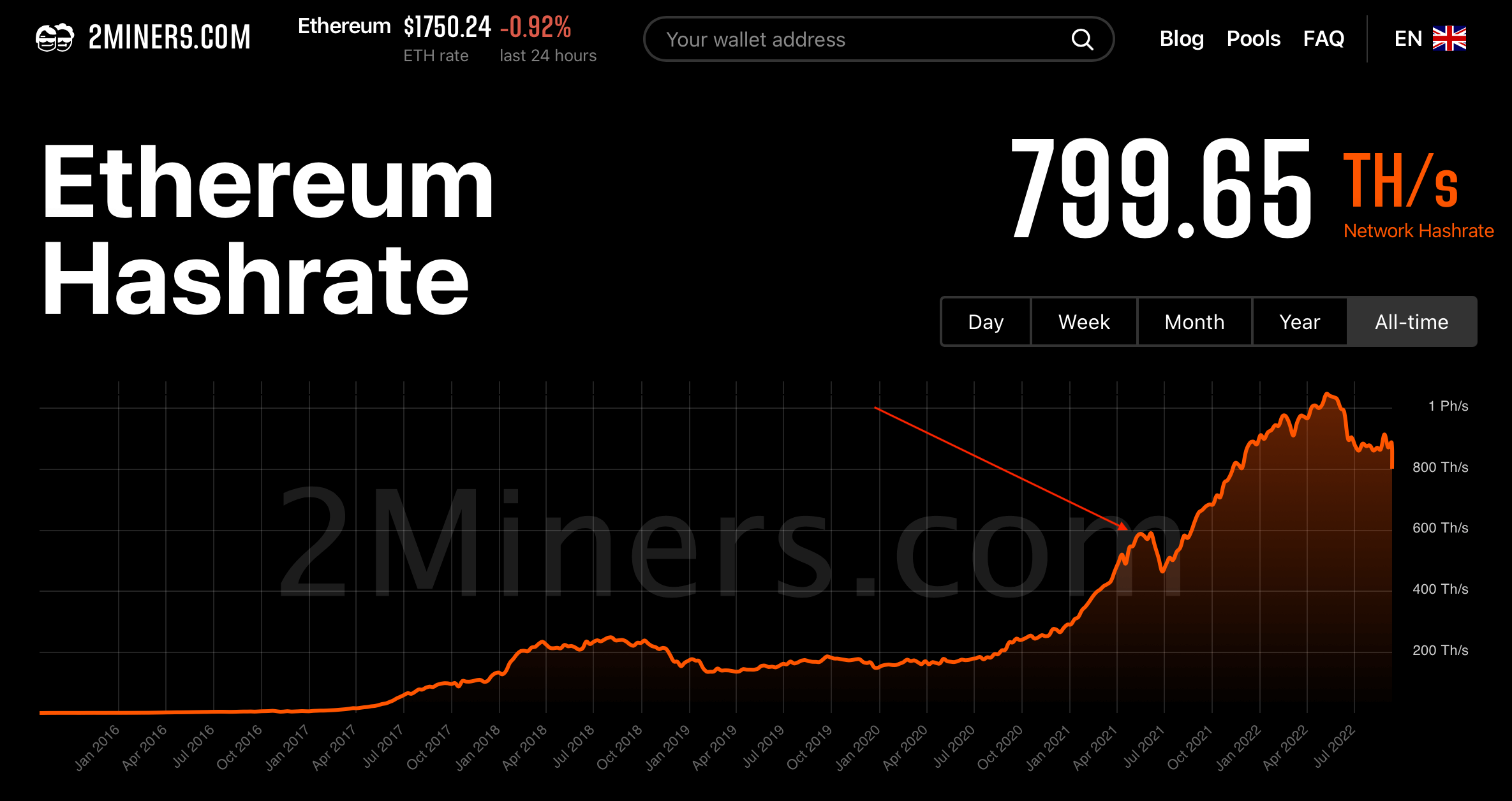

Let’s open Ethereum’s network hashrate chart and click on ‘All-time’. The chart shows a hashrate – all the equipment involved in Ether mining in the present or past. I started mining in 2017 when the hash rate was a little over 30 Th/s. In 2020, when I sold almost all of my equipment, the hash rate reached 150 Th/s, which was 5x higher. At the beginning of summer 2022, the hash rate exceeded 1 Ph/s, which was 30x higher than in 2017. Back in 2017, only geeks were interested in mining. Today there are 30x more miners. Everybody is mining: housewives, car wash owners, you name it.

I sold my equipment in 2020. I struggled to sell Antminer S9 and L3+ ASICs even for $100–$200. Now imagine my frustration when the exchange rate went up in 2021, and people were selling those ASICs for $1,500 and more!

Ethereum (ETH) Shifts to PoS

You’ve probably heard that Ethereum is shifting to Proof-of-Stake. In simple terms, it will put an end to Ethereum mining.

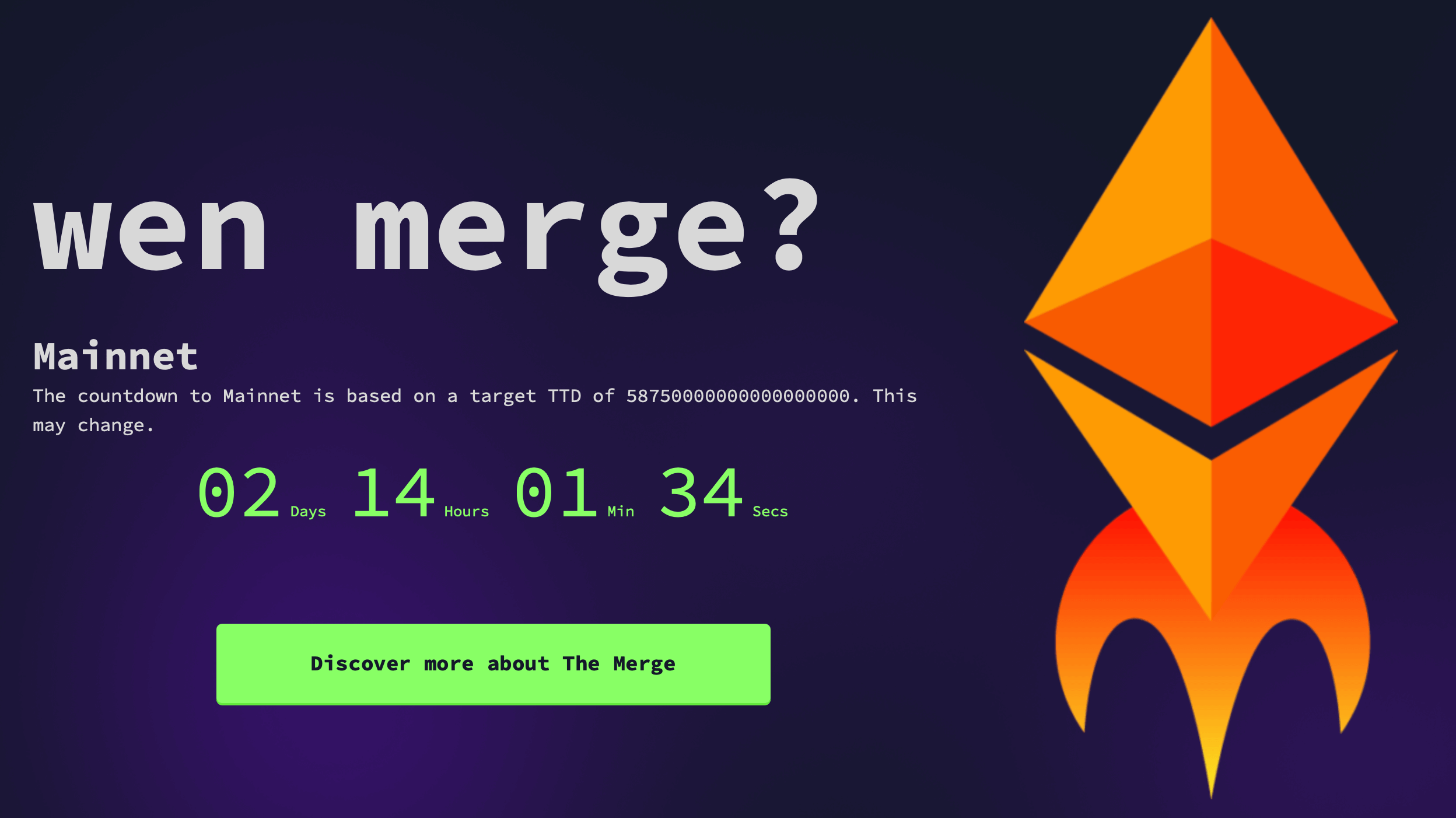

There are many other coins to mine of course, but it’s the end of an era. Ether mining is supposed to stop on September 14. You can follow the countdown on this page. Look at the countdown called Mainnet. When the timer stops, it will be the end.

This article already explains all you need to know about this, but it’s a long read and not everyone will make it to the end. Here, I would like to share my thoughts on what’s coming and what to do after the Merge. But first, let’s make sure we understand what’s happening right now.

GPU Mining Profitability

Ethereum Mining Profitability

Today Ethereum miners earn more than Bitcoin miners. Can you imagine? 95% of GPUs mine Ethereum, which means that most GPU miners are Ethereum miners.

Some ASICs also mine Ethereum, but their amount is insignificant.

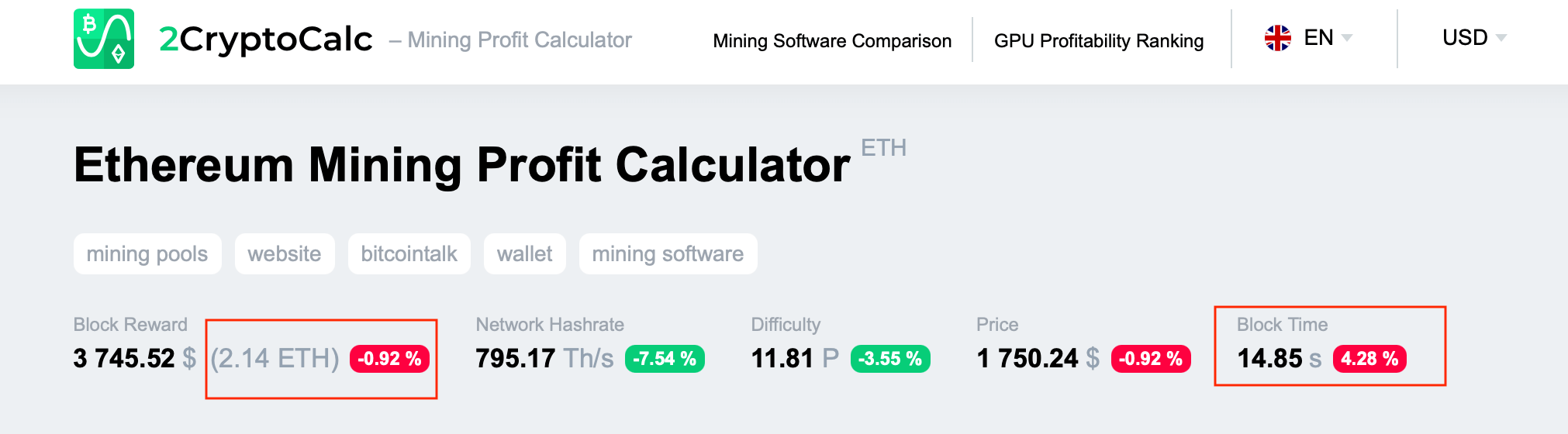

Block find time in the ETH network is 14 seconds. So every day 6,200 new blocks are found in the network. Miners get at least 2 ETH for each block. If we add an additional reward (e.g., for transactions), we’ll get 2.1 ETH. You can verify these values on the Ether page on 2CryptoCalc or through any other source.

Let’s multiply 6,200 by 2.1 and by Ether’s exchange rate of $1,750. We get 6,200 x 2.1 x $1,750 = $22,785,000.

Ether miners get $22,785,000 daily. Without making the same calculations for Bitcoin, let me just say that the resulting number is much lower.

Ethereum Classic, Ravencoin & Ergo Mining Profitability

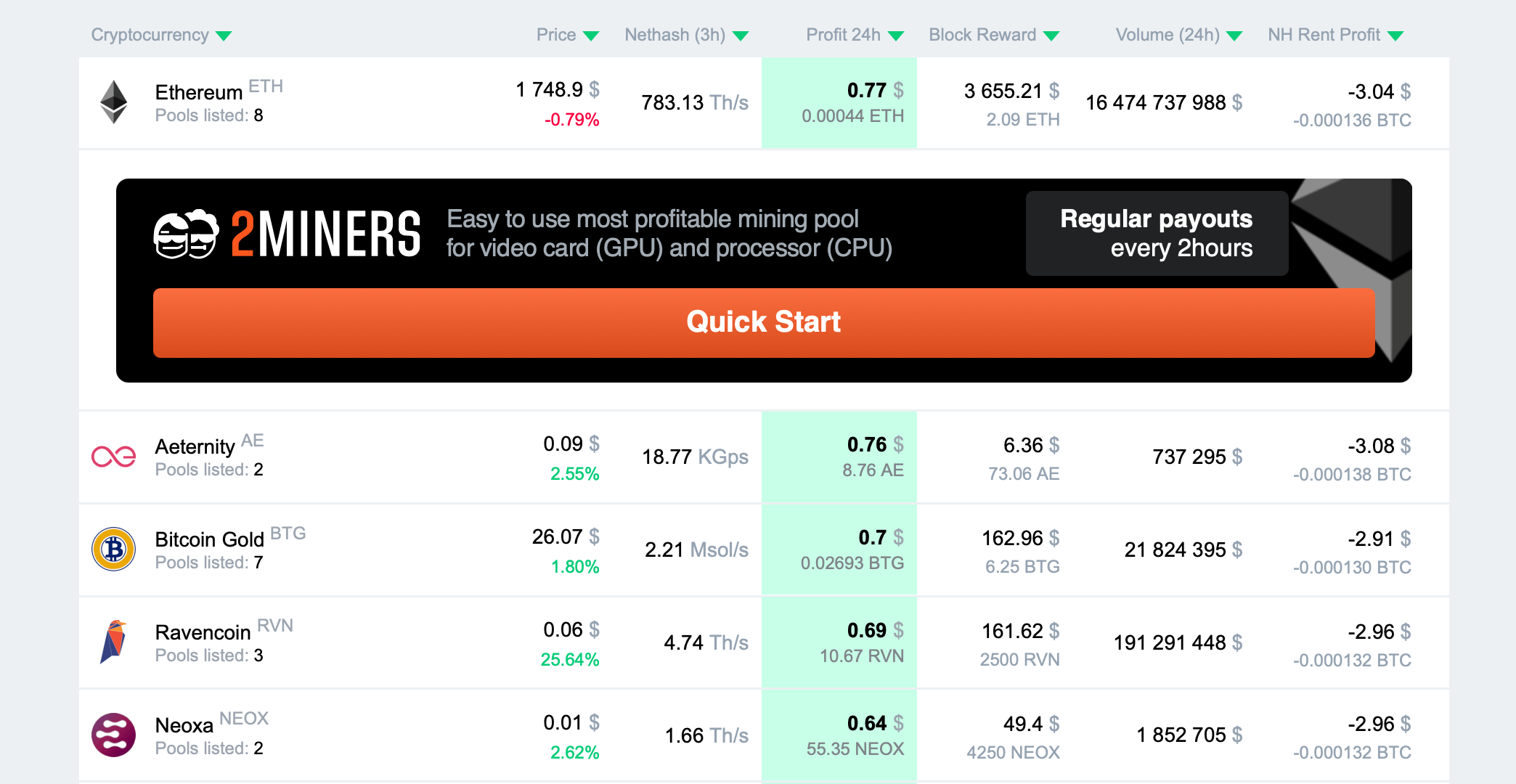

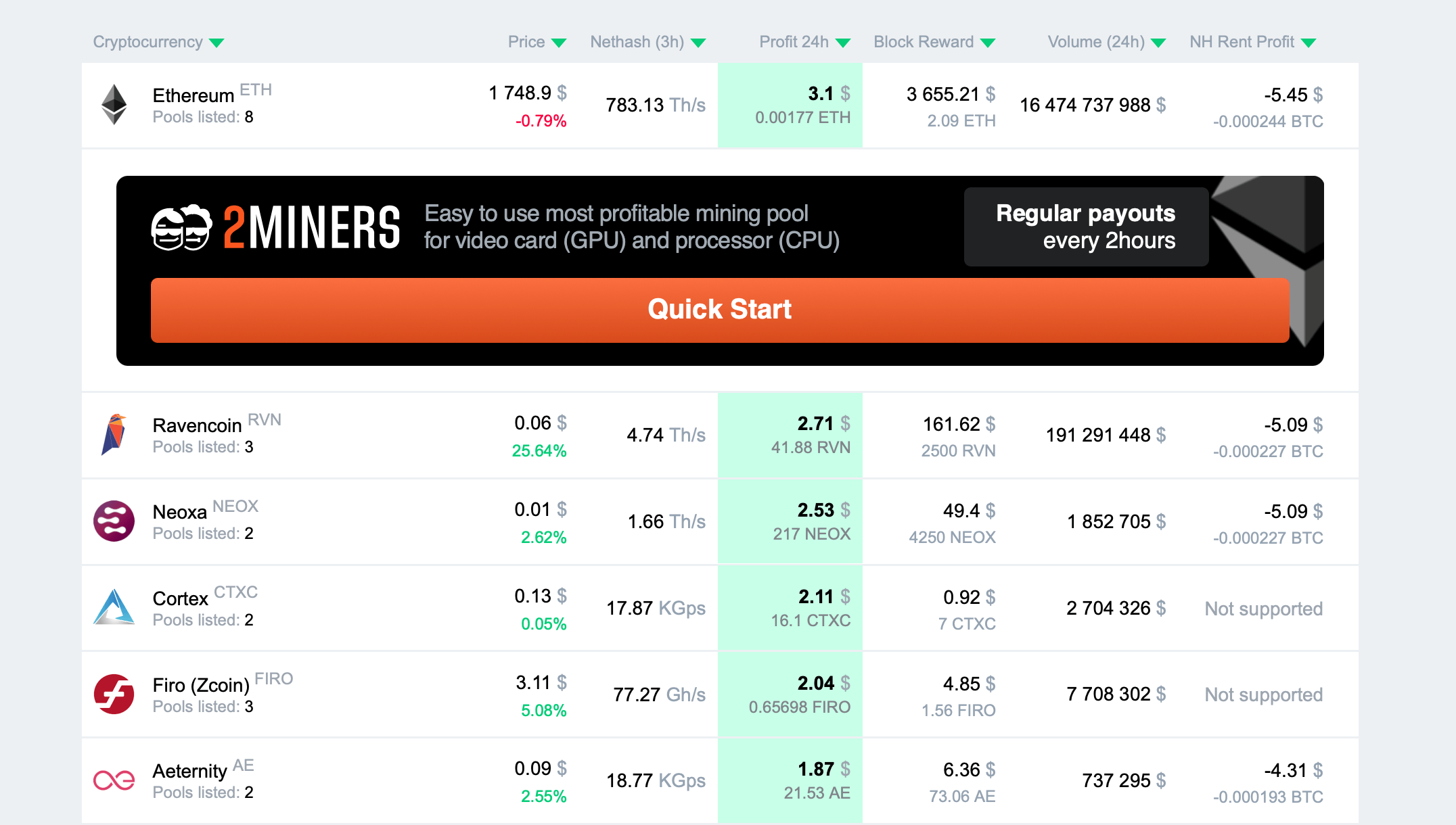

Let’s see how much GPU miners make on other coins and algorithms. Let’s go to 2CryptoCalc, click on the desired coins and take note of their block reward and block to find the time. Coinmarketcap will help with exchange rates. Now we just have to multiply these values. Ignore ZEC, ZEN, CKB, GRIN, and MWC, because they are mined on ASICs, as well as Monero because it’s mined on CPU.

Here’s how much miners make daily:

- Ethereum Classic — $750,000

- Ergo — $200,000

- Ravencoin — $135,000

- Flux — $50,000

- Neoxa — $45,000

- Bitcoin Gold — $20,000

- Beam — $10,000

- Firo — $10,000

- Cortex — $5,000

I stopped here because other coins bring even less.

Overall GPU Mining Profitability

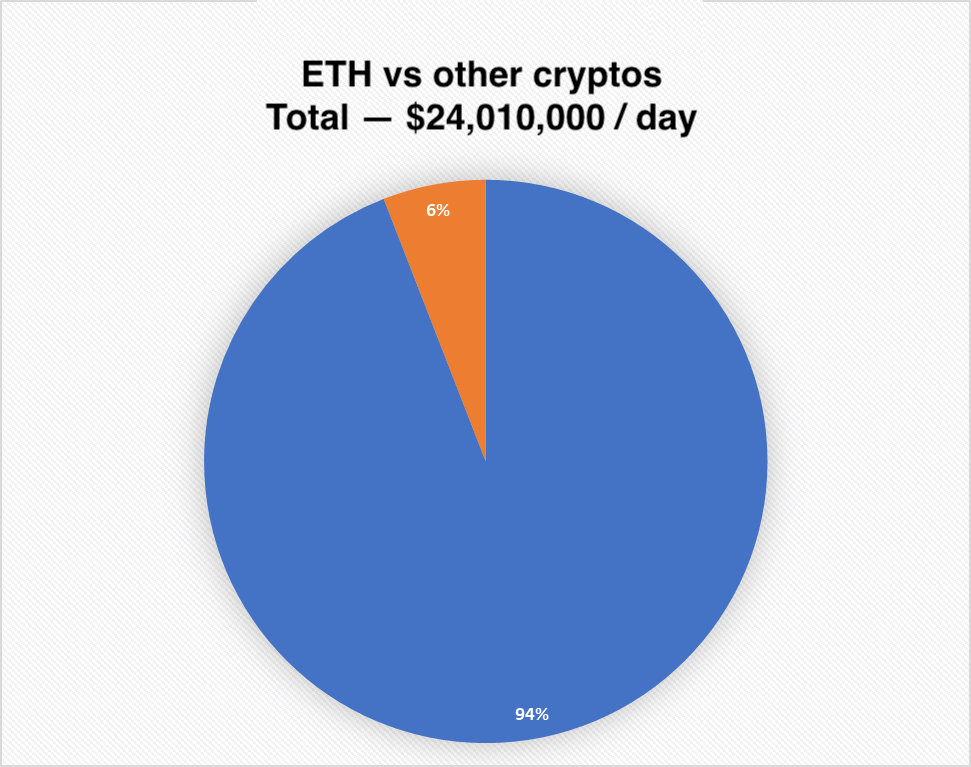

Let’s add up all the values. Ethereum + other coins = $24,010,000 per day, out of which Ethereum accounts for 94% and all other coins – for 6% (see the diagram below).

Imagine GPU mining profit as a big pie. The size of the pie mostly depends on the value of cryptocurrencies. It also depends on the block find time and block reward. The block finds time stays the same most of the time, while the block reward of a certain cryptocurrency decreases once in a few years, which is called ‘halving’. Imagine what will happen to the pie when Ethereum mining stops and miners are left without the huge blue part.

Mining Profitability after Ethereum Shifts to PoS

On September 14, Vitalik Buterin is going to take away 94% of the pie. GPU miners will be left with only $1,225,000 a day, instead of more than $24,000,000.

What to Mine after Ethereum ETH Merge?

It’s easy to guess that most miners will switch to ETC, ERGO, and RVN. In total, they bring over $1,000,000 daily: Ethereum Classic — $750,000, Ergo — $200,000, Ravencoin — $135,000.

If your goal is to hold Bitcoin, you can get paid in BTC for mining certain coins on 2Miners. It’s a very useful feature that saves a lot of time and money. Now you can get paid in BTC for mining ETH, ETC, ERGO, RVN.

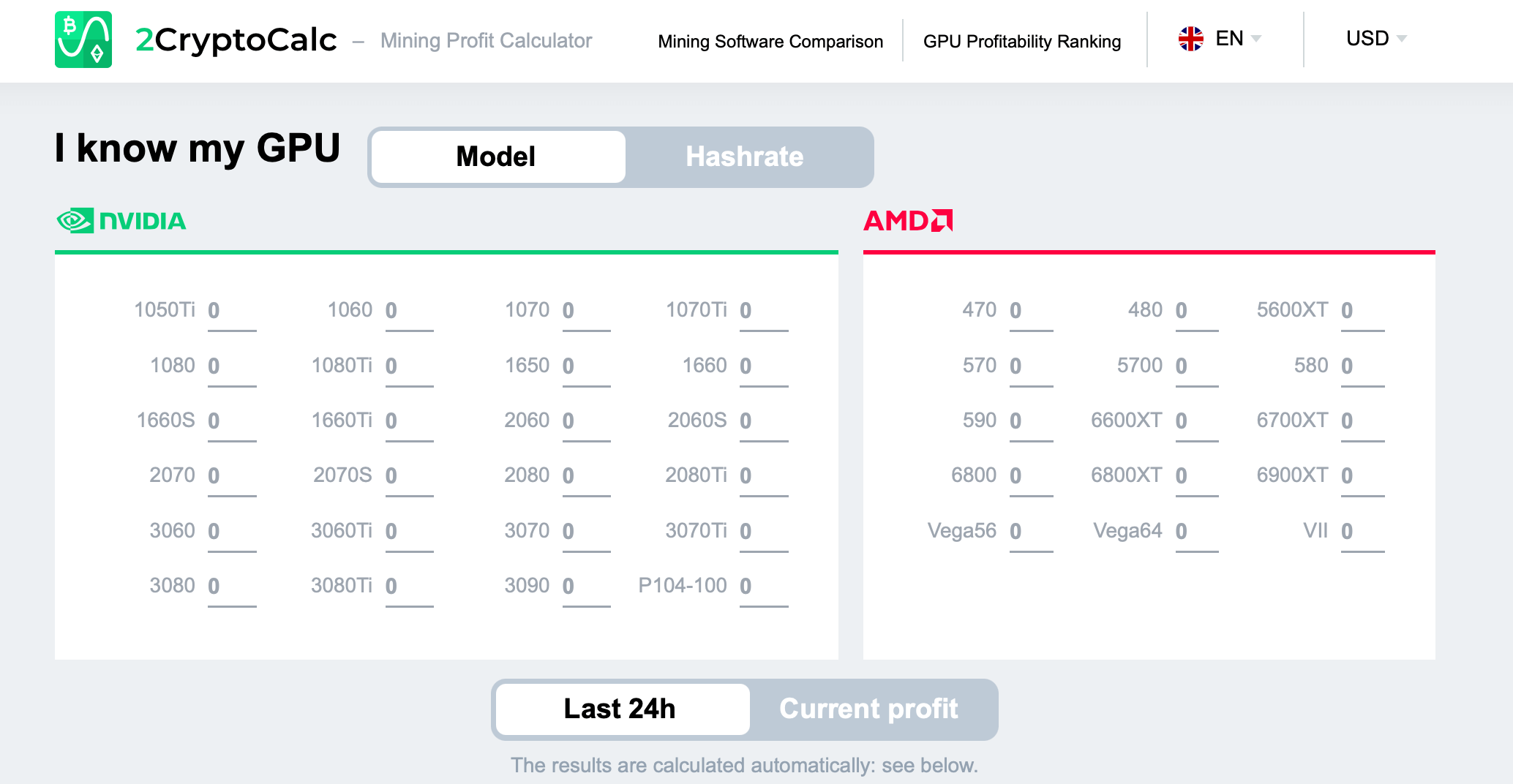

It’s impossible to predict which coin will be the most profitable after the Merge. As soon as Ethereum shifts to PoS, you will have to choose one of the coins and mine it for a few days until the situation clears up. Then you can go to 2CryptoCalc.com, indicate your equipment, and decide which coin you should mine and whether mining still makes sense for you at all.

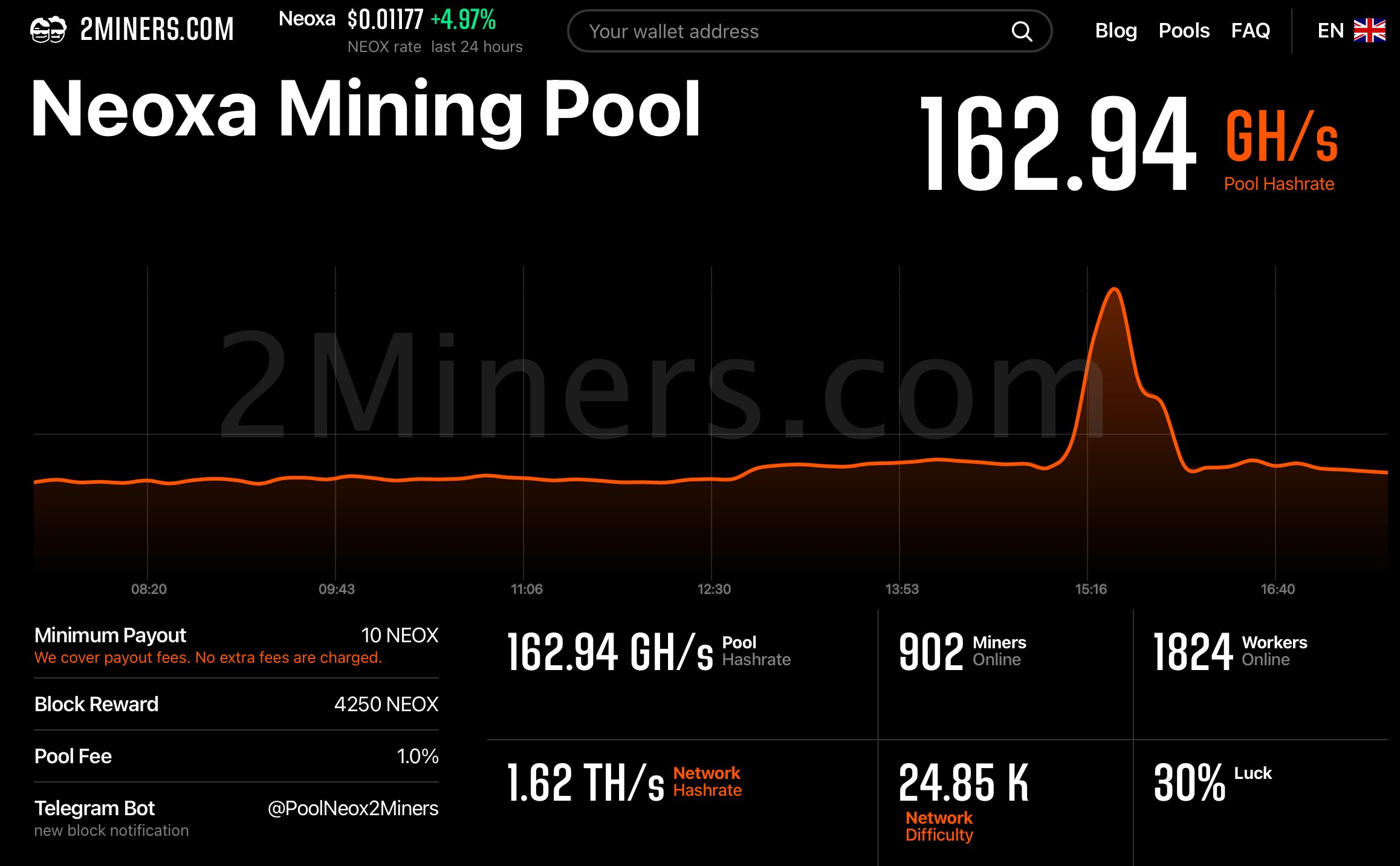

For the first few days, it may be better to mine one of the less known coins, like Neoxa, Aeternity, or Cortex. Industrial miners will consider such coins last. So you can go to 2Miners.com and think of which coin would cause you the least trouble.

Myth 1. Other coins are as profitable as Ethereum, so I can mine other coins

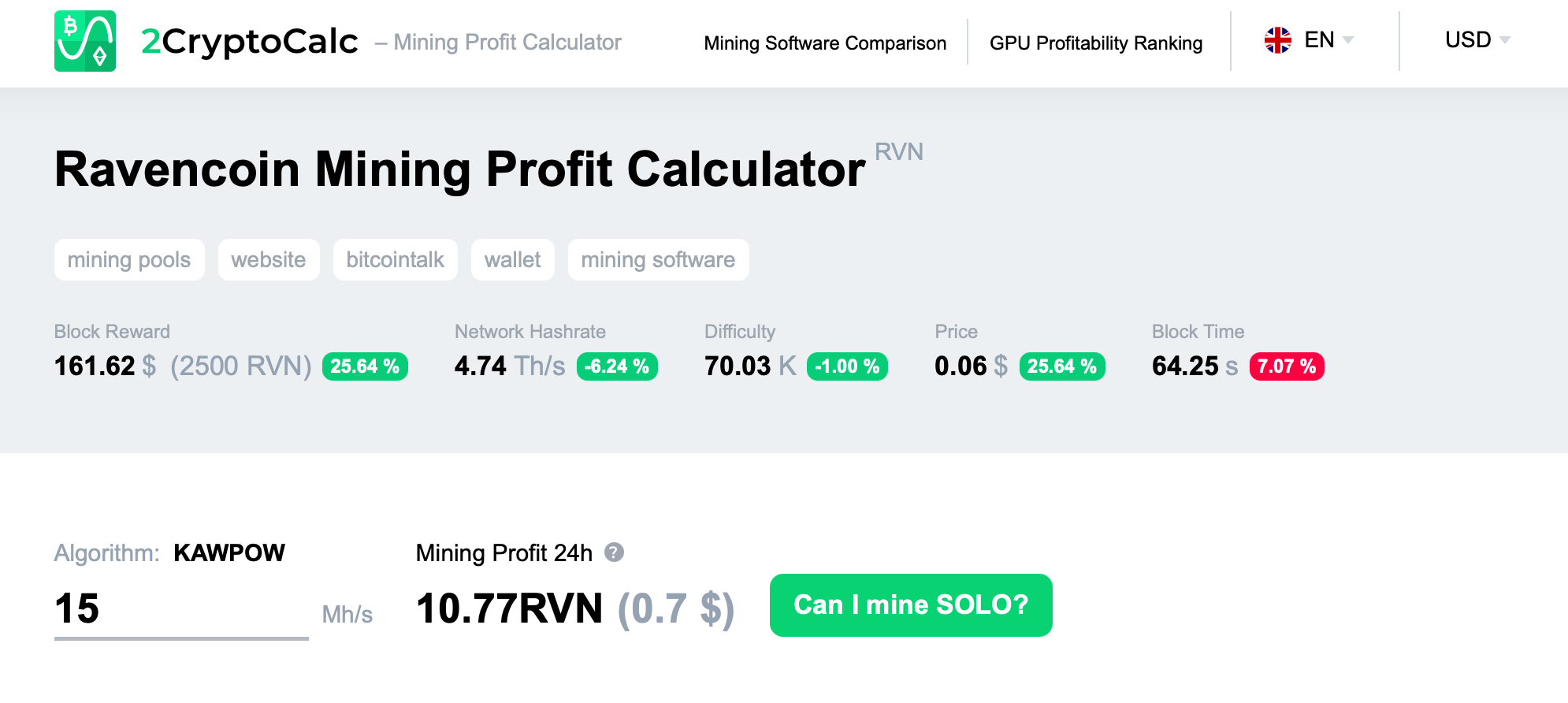

Sadly, it doesn’t work this way. When you are looking at the mining profitability of your GPU, you might think that RVN profitability is the same, and that of AE is even higher. With that in mind, you might decide to mine RVN when ETH is out. You can mine RVN of course, but its profitability won’t be the same.

Now RVN’s overall mining profitability is $135,000 per day, spread among a small group of miners. When Ether mining stops, millions of GPUs that are used to mine ETH will become vacant. What would happen then? Those GPUs will start mining other coins, including Ravencoin. RVN’s overall profitability will stay the same, but it will be spread among a much bigger group of miners. As a result, the RVN mining profitability of a single miner will decrease drastically.

Myth 2. Mining calculators lie

Mining calculators don’t lie, but they can’t predict the future. A calculator is a tool supposed to be used here and now. It can’t tell what will happen tomorrow, in an hour, or what profit to expect from Ergo when Ethereum shifts to PoS. Use calculators to estimate what to mine right now rather than after the Merge, which is useless.

Myth 3. Other coins will gain in value. Mining profitability of other coins will grow

I’ve seen so many people in the chat write something like: “When Ether shifts to PoS, everybody will start mining Neoxa (or another coin), and its price will go up.” The problem is, its price won’t go up. Be it 100 users or 10,000 users mining Neoxa, its overall profitability won’t change. Now there are 100 people selling Neoxa every day, whereas after the Merge there will be 10,000 sellers. Why would its price grow? The price grows only if the demand grows, whereas miners are sellers, so they’re increasing the supply, not the demand.

There are a few scenarios that miners could benefit from. Investors might believe in this coin and start buying it on a large scale. Or Neoxa might win a contract with Epic Games and become world-famous. Although it’s possible, it has nothing to do with what’s happening with Ether today.

Myth 4. Mining profitability will be 20x lower

Today 94% of miners mine ETH, and 6% mine other coins. Many people think that all ETH miners will switch to other coins, and so the profitability will be 15–20x lower. It’s impossible. Many, if not most, Ethereum miners will disconnect their equipment forever. I think that GPU mining profitability will be 8–10x lower, but definitely not 20x lower.

There is a great definition of mining in the article titled What to Mine when Ethereum Goes POS:

Mining is the process of getting rewards for using the computing powers of your equipment.

When mining makes you lose the money you stop mining. Apart from profits, you should think about expenses – miners have to pay for electricity.

When you make more money from mining than you’re spending on electricity, that’s great.

What will happen when profitability drops so much that you make just enough to cover electricity costs? And what if it drops even more and you don’t even make enough money to cover the expenses? You stop mining.

Everything will depend on how much you pay for electricity. Those miners that pay a lot won’t have any choice but to stop mining. Let’s remember that nowadays electricity is expensive in many countries. It’s not going to be the first time that miners are disconnected from the network. But it’s definitely going to be on a much larger scale than ever before.

Look at Ethereum in 2021. Computing powers engaged in mining fell by almost 50%.

Now let’s take a look at Bitcoin. In 2018 and 2021, the hash rate fell by a third.

Can we predict the profitability after the Merge in September? Unlikely.

The Future of GPU Mining

I am not a fortune teller, but this September is definitely going to be remembered by GPU miners all over the world.

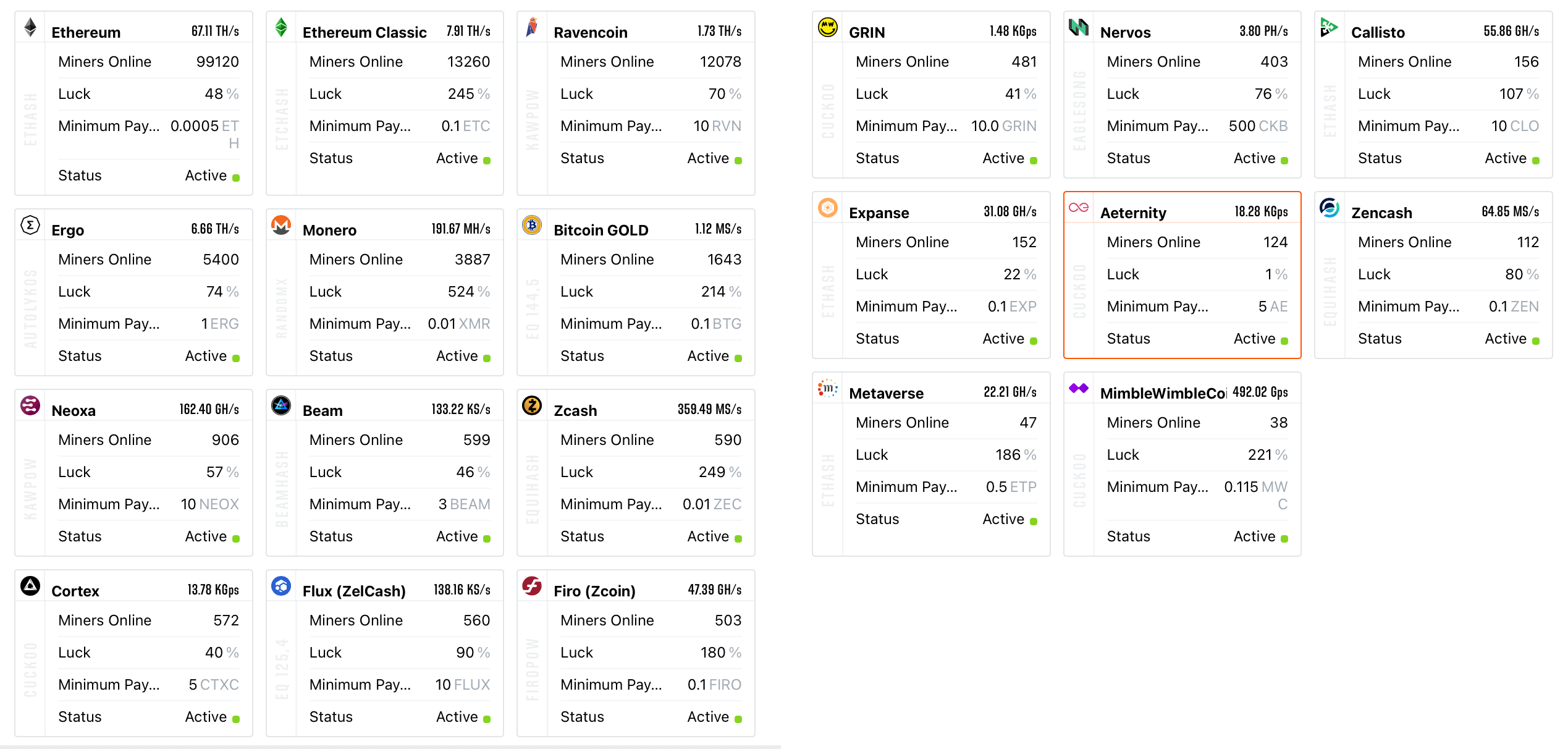

People with very low electricity rates will continue mining. Many miners across the world will disconnect. 2Miners will become the biggest GPU mining pool. It supports all the coins that you could think of. There are 20 coins available (19 without Ethereum).

Is there a chance that the situation will get better? Definitely. The cryptocurrency market today is 3x lower compared to its all-time high. If mining profitability first falls tenfold and then increases threefold, it means that overall it would fall just threefold. Not bad. And what if Bitcoin reaches $100,000 in value thus leading to the growth of all other cryptocurrencies? You might be skeptical because Bitcoin is having a hard time withholding even a $20,000 value. But who knows, it used to be valued at $1, then $100, and then $1,000. And every time people were saying that it was the limit, and it couldn’t grow even more.

Go ahead and read my first article – I’m sure some of you could relate to the wins and failures of my past. I’d like to thank the editors for publishing my second article. Even if I stop mining, I will remain an active part of the fantastic community that you’ve built for many years to come.

We highly recommend you to join our miner community in Telegram or one of the local chats in Russian, Turkish, Spanish, and Chinese.