There has been much controversy surrounding this change – on the one hand, it aims to expand block capacity so that in situations where a large number of transactions are published to the network, a long wait to send a transaction can be avoided. It also offers a simple solution to calculate the cost of gas when publishing transactions.

However, the latter change has generated a lot of controversy among the mining community. But before describing the problem in more detail, let’s briefly recap what the gas is on the Ethereum network and what its cost affects.

Contents

How Transactions In Ethereum Are Executed

Any transaction on the network (whether it is a simple transfer of tokens or funds or a smart contract operation) is a set of operations in a special machine language developed specifically for Ethereum and executed by its EVM virtual machine. Each operation has a price; the more complex the code to execute, the more “expensive” the transaction is for the computer checking it in the blockchain (usually a mining pool that forms new blocks by including these transactions in them). To compensate for machine time, the concept of gas, and its cost, was invented. What is Gas in Ethereum? Ethereum Transaction Fees. The unit cost of gas for a transaction is set by whoever sends the transaction. The higher the cost per unit of gas, the more likely the miners are to include your transaction in the upcoming blocks.

In situations where the network was too overloaded with too many transactions waiting to be sent, senders had to set a higher and higher cost per unit of gas to get their transactions into the new blocks sooner and sooner. This gave rise to a cascading effect, with each successive new transaction being posted at a higher unit gas cost than the previous one.

Of course, miners liked that very much – the higher the cost per transaction, the higher the profit from each mined block (remember, that’s 2 ETH basic reward per block plus the sum of all fees for the transactions included in that block).

But it was inconvenient for ordinary users – not only that they had to overpay for sending a transaction in situations of network congestion (and these happen more and more often due to the increasing number of smart contracts and popularization of the coin in general), but also it’s not clear what exactly the cost of gas should be, to make sure that your transaction will be sent soon and not just hang for hours in the waiting list (not to mention that sometimes users were mistaken by an order of magnitude, manually entering gas cost when trying to push through a transaction, and sent, for example, 1 ETH with 10 ETH commission).

EIP-1559 – The New Transaction Concept

The response to the high and unpredictable transaction fees in Ethereum was EIP-1559. It introduced a new concept – the base cost of gas – a fixed value, smoothly changing depending on the network load (if the expected transaction numbers are low, the base cost smoothly decreases, as soon as there are more of them – smoothly increases). From now on, whenever a new type of transaction is sent, the base cost of gas multiplied by the amount of gas spent is always used for calculation, no more and no less. This eliminates the possibility of errors with sending transactions with disproportionately large commissions, and it is easier for the wallet programs to calculate the cost of commissions, as they are formed according to a fairly simple and predictable scheme. The new type of transaction is called a “type 2 transaction,” and canonical transactions are called a “type 0 transaction” – and don’t ask what happened to type 1 transaction 🙂

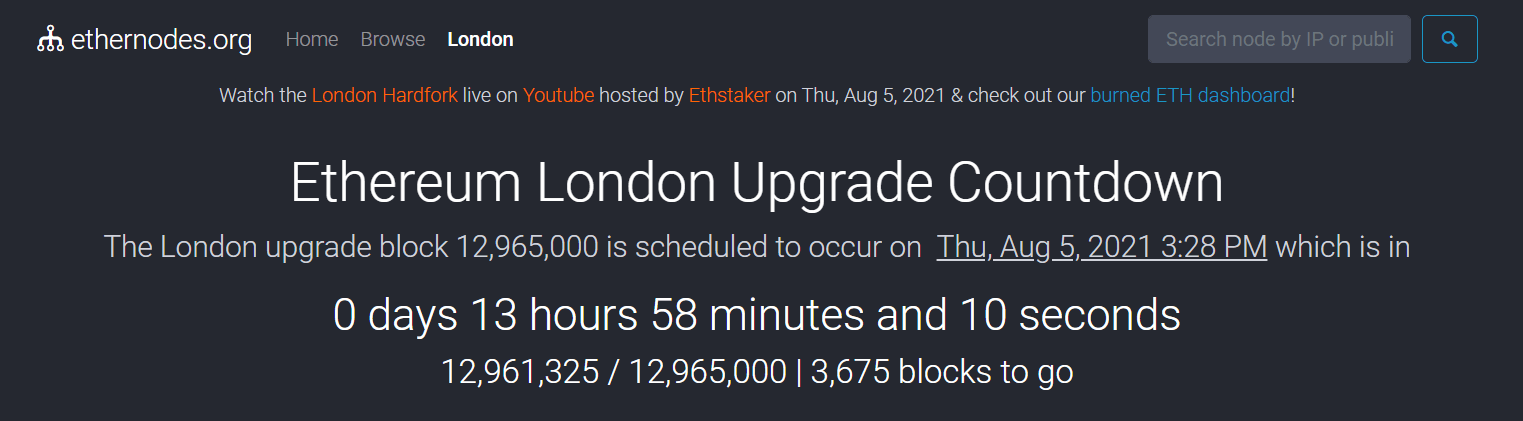

However, in addition to the above, it was proposed to “burn” commissions formed in this way (i.e. coins spent to form transactions will disappear irrevocably) – this will create a deflationary model, which in theory can make ETH value higher in the future (as the number of coins in circulation will grow slower than now). However, it also means that miners will stop making profits from the number of fees, being left with only the basic reward per block (2 ETH). That was the reason for heated debates, and to sweeten the bitterness of the parting, the notion of a “tip” was also added – some small amount on top of the standardized commission to make it more interesting for miners to include your transaction into a block (but the math is done in such a way that a very small amount is enough to make sure the transaction will get into one of the next blocks – so no significant amounts are involved – they are expected in the range of 1 to 9 gwei). In any case, it was still decided to accept EIP-1559 and run it in a hard fork process called London at block 12,965,000.

How The Miner Fees Are Burned?

The total gas amount of all transactions included in the block is taken, multiplied by the base gas cost for that block, and then that amount is destroyed irrevocably. For Type 2 (new) transactions, this will be exactly the total amount of fees per transaction (not counting tips, if any). For older transactions, since the cost of gas for them is much higher, it will mean only a fraction of the total amount of fees.

At first, the reduction will not be too noticeable, since most wallets and other software will continue to send transactions of the old type, the commission for which will not be burned in full.

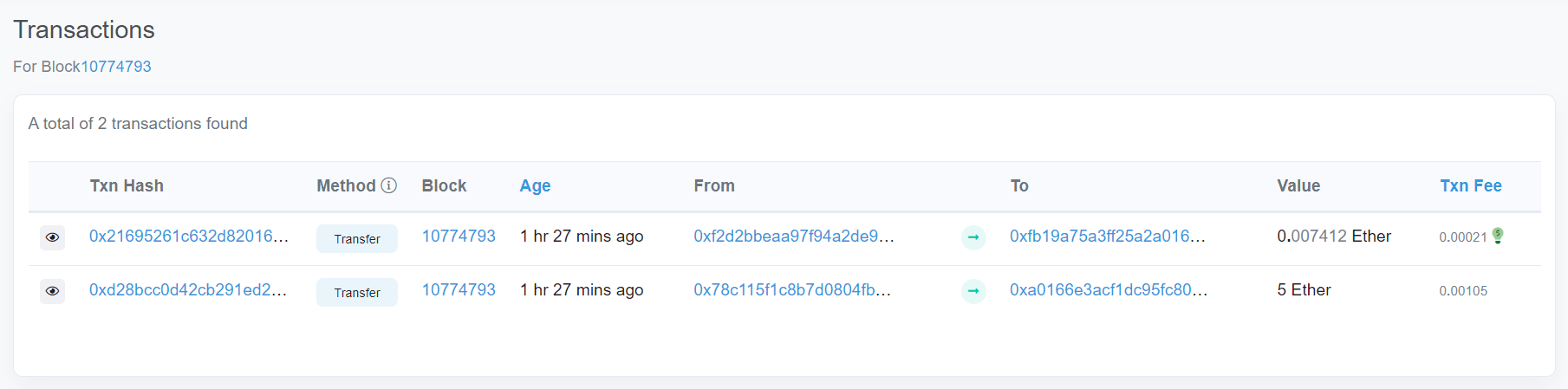

Let’s have a look at the Ethereum Ropsten (Testnet) block 10,774,793.

This block contains just 2 transactions. The first transaction is Type 0 and the second one is Type 2.

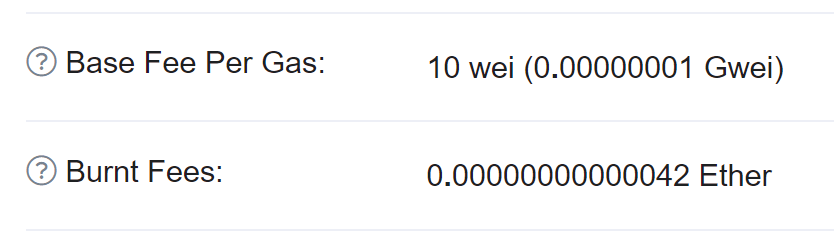

Base Fee Per Gas was 10 wei (0.00000001 Gwei).

The block contained 2 transactions 21,000 gas each so 21,000 x 10 x 2 = 420,000 wei were burned in this block or just 0.00000000000042 Ether. Not a disaster, right?

How The Mining Rewards Change?

What does the EIP-1559 implementation mean for us as miners? First, the revenue generated from Ethereum mining will gradually decrease – the more Type 2 transactions hit the block, the more fees will be burned, consequently reducing the revenue from each block found. Thanks for Eden Network (formerly Archer DAO) we will try to keep miner rewards as high as possible with the so-called Miner-extracted Value (MEV) profits.

Secondly, as the number of Type 2 transactions in the network increases, we will have to switch to them as well, accordingly, all payments to miners will at some point be made at their expense (by taking away the cost of the transaction from the amount to be paid).

Currently, 2Miners leaves everything as it is (payments to miners at the expense of the pool), but in the future we will closely monitor the network and make a corresponding announcement, additionally introducing new pool features (it will be possible to specify the minimum payment amount individually, so as not to lose money on frequent payments).

UPDATE: Unfortunately, we were forced to change the payout model of 2Miners Ethereum pool. New 2Miners Ethereum Pool Payout Model

Remember to join our Telegram chat and follow us on Twitter to get all the news as soon as possible.