The miner decided to share his story anonymously.

Contents

- Mining Epidemic

- First Mining Rig

- Ethereum Wallet

- Too Late to Start Mining

- Mining Equipment Room

- First ASIC Miner

- More Mining Equipment. Transition to Linux OS

- How Much Money I Could Have Made with Mining

- Mistake One. I wasn’t selling cryptocurrency.

- Mistake Two. I started investing.

- Mistake Three. I was mining shitcoins.

- Mistake Four. I was greedy and careless.

- Mistake Five. I kept money on crypto exchanges.

- Mistake Six. I lost control over my hardware.

- Mistake Seven. I didn’t know how to choose mining hardware.

- End of Mining

- Future of Mining

- Mining from Home

Mining Epidemic

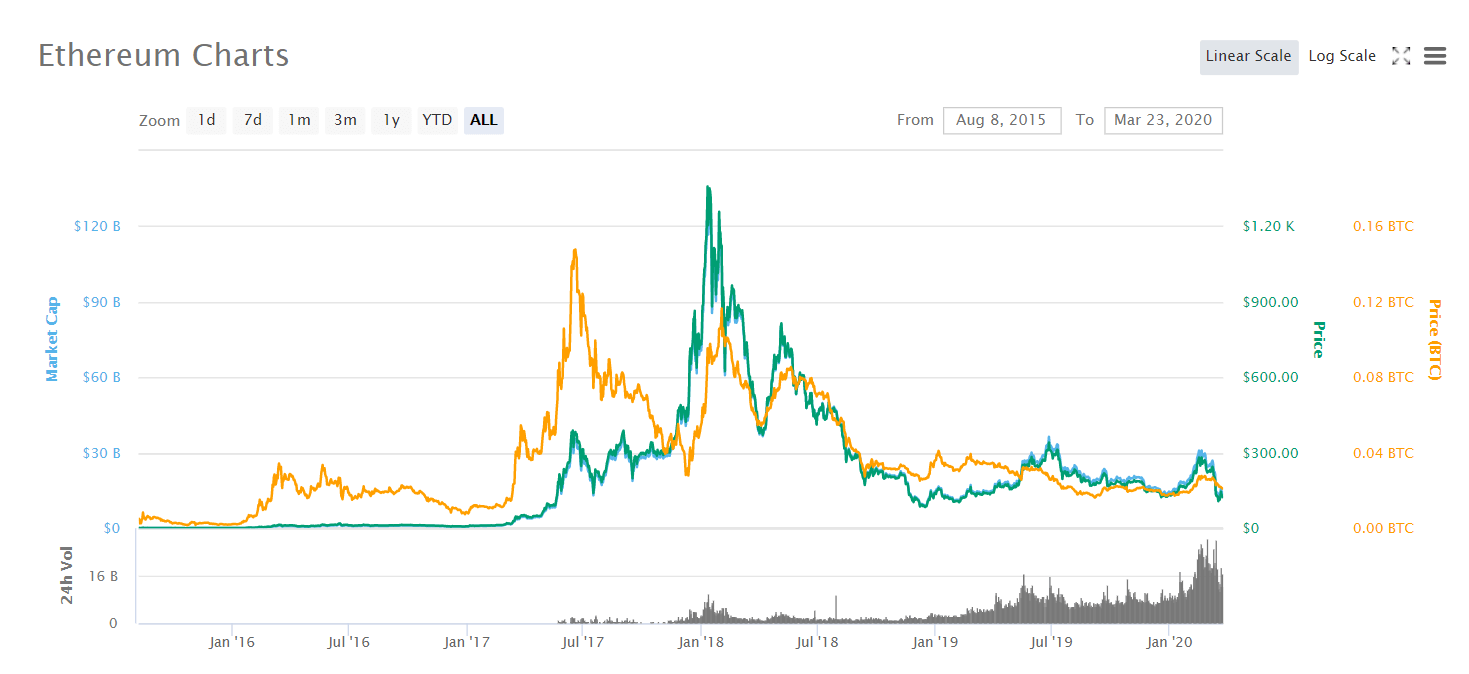

Today we are in the middle of the coronavirus outbreak, and once there was a mining epidemic. Mining epidemics, to be precise. The biggest one happened in 2017. What provokes such epidemics? Of course, it’s the growth of cryptocurrencies in value. 2017 was no exception. In spring 2017 Bitcoin grew from $1,000 to $3,000, and Ethereum grew even more. It leaped from $10 to $300.

Suddenly, mining became an extremely profitable business. Everybody talked about it. Literally every one. The Internet was exploding.

What is mining? How to mine? I didn’t know anything. I called my friends and they didn’t know anything either. So I decided to try mining on my own.

For those who are far from the mining industry, I will specify that in 2017 it was already impossible to mine Bitcoin using anything but special ASIC miners. At the same time, you could and still can mine Ethereum using GPUs. That’s right, the same graphics cards that you use to play League of Legends, Grand Theft Auto V or Fortnite.

First Mining Rig

ASICs were hard to choose. I had no idea how they work and was not convinced by the photos on the Internet. They looked like those typical “Made in China” devices of poor quality. I decided to opt for GPU mining. Several graphics cards, usually six or eight, are combined to form a single computer/rig. And you are good to go. Here comes the first problem. Graphics cards cost way too much. The mining epidemic caused an increase in prices by at least two times.

I somehow managed to get eight Nvidia 1070 graphics cards, paying $400 for each, and began to build my first rig. What a nightmare it was. Now there are more resources, like 2Miners Blog 🙂 but in the past, you had to read those awful forums and gather information bit by bit.

Luckily, I knew how to build a computer, so I didn’t have problems with installing a processor into a motherboard or installing Windows OS. So I finished my first rig. I just had to setup BIOS, changing settings this and that way, until Windows finally detected all of my eight graphics cards. I should say that changing BIOS settings to make eight graphics cards work on Windows was a real adventure. I downloaded the mining software. Now I had to get a wallet.

Ethereum Wallet

What would any sane person do? Google “Ethereum”, go to the official website and download a cryptocurrency wallet. That’s what I did. I launched the wallet and was asked to wait. It said that I needed to synchronize blocks. So I did that.

By the way, the rig wasn’t working, because I didn’t have a wallet yet.

I went to work, and when I came back in the evening, the synchronization wasn’t over yet. The wallet took up the enormous amount of my computer memory. I found a way to close the sync window, and only then I found out that I could simply copy my wallet address without waiting for the whole blockchain to load. So I copied the address. I added the wallet address to the mining program, and the process started. I put the rig in the hall so that it didn’t disturb my sleep.

When I woke up, I checked the wallet and saw that the synchronization was still going on. I decided to Google the problem. They said that a regular hard disc wouldn’t do and you needed an SSD. Forums advised getting Jaxx, a multi-token wallet. Instead of storing a blockchain on the computer, the wallet stores it somewhere on its own server. Paranoid as I am, I didn’t like it. But I had no choice. I wanted those precious coins on my wallet so bad. I downloaded and installed the wallet, copied the address, reconfigured the miner. And then I went out. When I came back in the evening and opened the wallet, I saw something. Success!

I was so excited. So I said to my wife: “Open that bottle of red wine from the birthday party. Let’s celebrate!” “What an idiot,” she thought, “Keeps this damn noisy thing in our apartment and is so happy about it!”

Too Late to Start Mining

One week passed without any problem. I was regularly getting Ether on my wallet. I calculated expenses on electricity and discovered that the rig was bringing me $10 per day. So it was supposed to pay off in one year. I knew well that cryptocurrency exchange rates are extremely unstable, but at that point, I couldn’t be stopped.

I was making money out of air. Every single day. And most importantly, a pay-off period was just one year. Where else could you find anything like this?

Now, sorry if I say something stupid in terms of economics, but who would offer you a 100% annual interest rate? I was convinced that nobody would. On the Internet people were saying that soon it would be over, it was too late to start mining, only those who started a year ago were making money, etc. But I was unstoppable.

I started looking for cheap graphics cards because I didn’t want to overpay. Motherboards, PSUs and other parts were easier to find because they were always available in regular shops. Sometimes risers that I wanted were out of stock, so I had to buy poor-quality models. A month later, I already had five mining rigs in my apartment, and I was making $60 per day. At that point, there were rigs not only in the hall but literally everywhere.

For the night I put them in the hall and in the kitchen with the window wide open. Otherwise, it was impossible to sleep because of the heat and the noise.

One day I woke up at night to go to the bathroom, but then I stopped in the hall. I smelled something electrical burning. I thought they were my rigs, but then I realized that the problem was somewhere else. The wire going into my apartment was hot as hell, and the plastic around it was melting off. I quickly turned off the rigs. I was glad I didn’t burn anything. But I couldn’t go on like this. It was time to find a place for my rigs.

Mining Equipment Room

Yes, I needed to build an equipment room. What other choice did I have? I couldn’t say to a landlord that I wanted to mine cryptocurrency. So I called factories and industrial areas explaining that I needed space for a small data center (server room). Preferably with a window and 20 kW of power. I opted for old factories because I thought they would have fewer problems with power.

A week later I found the space and relocated my rigs there. The room was small, 15–20 square meters, but with two large windows that I had to open right away to cool down my rigs. Otherwise, everything was heating up badly, and keeping the door open was not an option. What if someone would steal my cards?

That’s how I started a large-scale mining business. Just joking. People put the billions worth of equipment right next to power stations. And I was not even close.

First ASIC Miner

I built a couple of new rigs, but I wanted more. I was really curious to try ASIC mining. Besides, it’s best to diversify. What if Ethereum mining died? Bitcoin, on the other hand, had been around for almost ten years. I decided to try.

I bought my first ASIC and launched it. I can’t even describe how much noise it was making. Good thing I didn’t keep it at home. It would have been unbearable for me and my neighbors. ASIC setup was super easy. I just added the mining pool address, my wallet, and that was it. Much easier than with rigs. A pay-off period was less than a year.

“Wow, this thing really works,” I thought, “I need to get more.”

More Mining Equipment. Transition to Linux OS

I built a few more rigs and ordered different ASICs from China. Antminer L3+ to mine Litecoin, Antminer S9 to mine Bitcoin, and Antminer D3 to mine Dash. I also bought Antminer A3 for SIA, but it happened a year later.

At that point, I had both Nvidia and AMD rigs. Sadly, to make AMD cards mine correctly, I had to upgrade each card separately. Upgrades (timings) were not always easy to find. And even after upgrading I had to spend a lot of time to configure GPU overclocking in Afterburner so that a graphics card gave out a maximum hash rate. Moreover, AMD cards heated everything ten times as much as Nvidia cards. It depended on the model of course, but generally, they were super hot. Devil, for example.

I couldn’t control my rigs anymore. There were constant errors, GPU bugs, unexpected Windows updates. Then TeamViewer suspected commercial use and limited my connection time to five minutes. And then I had to wait for ten minutes. Instead of having dinner with my wife, I had to go to my equipment room and reinstall an operating system.

I installed Linux on all of my rigs. The first installation took me some time, but I did the rest pretty fast. I was sorry I hadn’t done it earlier. It was so simple. Online monitoring for just a couple of dollars a month for each rig.

Okay, now let’s end the boring part. Everybody wants juicy details.

How Much Money I Could Have Made with Mining

I could have made tons of money. Did I make tons of money? Rather no than yes. Because I made a lot of mistakes. But they do say that you learn from your mistakes, right?

How much money did I spend on mining equipment? 200 thousand dollars. That’s right, I could have used that money to buy a nice apartment.

How much money could I have made? No less than 400 thousand dollars. I could have recouped the cost of equipment and earned as much on top.

What mistakes did I make? Why did I earn much less?

Mistake One. I wasn’t selling cryptocurrency.

What is mining? Mining is the process of getting a reward for calculations. You buy hardware with the purpose of making money, real dollars. You must make them every day.

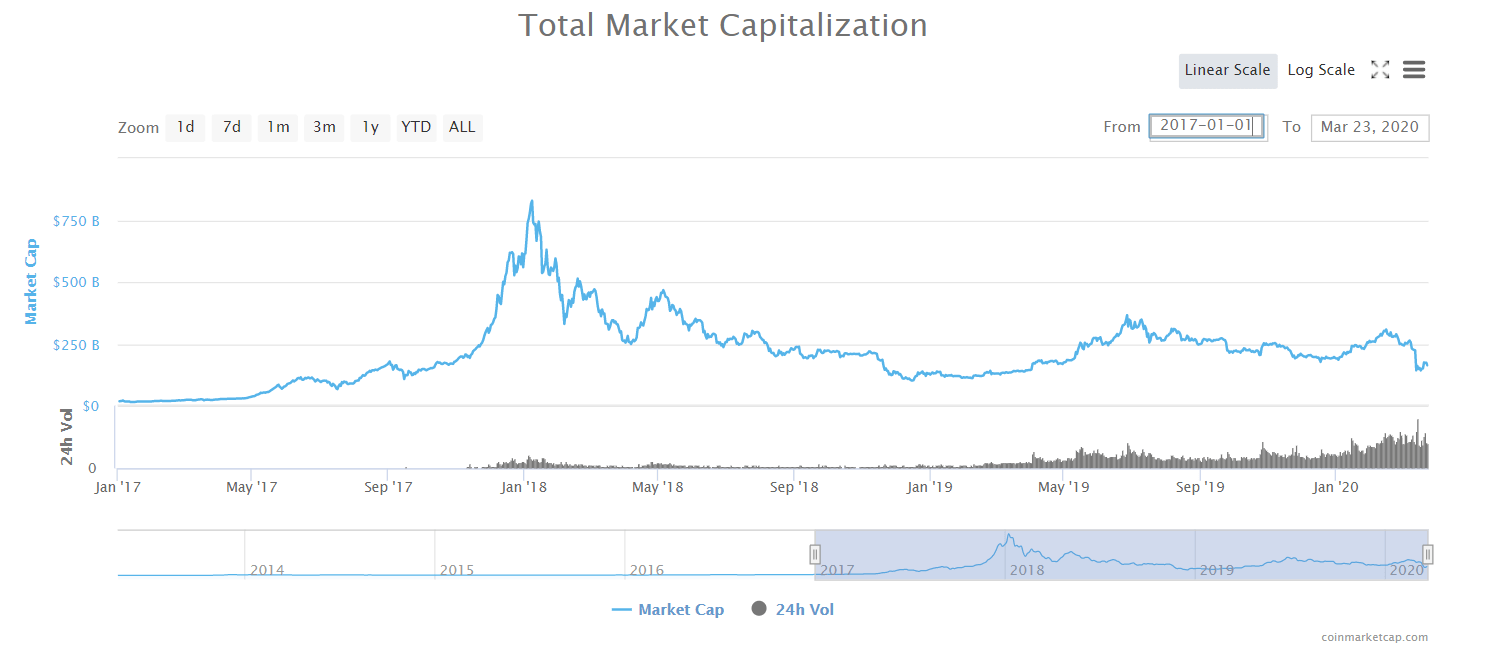

I wasn’t selling my cryptocurrency because my living conditions allowed me to do so. Exchange rates were constantly going up. So I held my cryptocurrency. My savings were growing by leaps and bounds. I was dreaming of buying one Tesla, then another one. Suddenly, all went down. In spring 2018 Bitcoin and other cryptocurrencies fell even more.

A year later I hoped that Bitcoin would go up, but it didn’t happen. I was losing money every day at the same pace I was earning it in 2017. I didn’t want to sell Bitcoin for $10,000. Not so long ago it was valued at $20,000. Selling for $8,000 was just foolish. I was sure it would grow soon. Then it went down to 3 thousand. At that point, there was nothing left to sell. I was trapped.

Conclusion: Once you get cryptocurrency, sell it.

Mistake Two. I started investing.

I was actively trading my Ether and building my cryptocurrency portfolio. I had never traded in the stock market, and this was a new niche, exciting and unknown. I was researching cryptocurrency projects and buying their cryptocurrency or tokens. I invested in ICOs. One ICO brought me twice as much, another one – three times as much.

Wow, I was born to be an investor!

Later I realized that anyone could be outstanding in the rapidly growing market. Even the worst investor would gain profit. But then I fell so bad.

After a year and a half of my cryptocurrency adventure, by the end of 2018, I realized that there is only one coin that rules. It’s Bitcoin. Others are just rip-offs. Okay, maybe Ether is also fine. But that’s it.

Conclusion: Mining and investment are not the same things.

You can’t do it all. You can either mine or gamble on the exchange. Everyone must do their own thing. In order to gamble on the exchange, you don’t have to mine, and vice versa. In order to mine, you don’t have to be an investor.

Mistake Three. I was mining shitcoins.

Euphoria is a dangerous thing. In 2017–2018 cryptocurrency projects were growing by leaps and bounds. I was getting bored, so I was always searching for something new. There were a lot of new coins to choose from. Those who were good at programming copied Ethereum or Bitcoin, changing a few words in the code or even leaving it as is.

The same wallet, the same infrastructure. They changed only a logo. I mined a lot of coins. WhaleCoin, PegasCoin, Musicoin, just to name a few.

I held everything. Sometimes I waited for an exchange to add a new coin and sold at once. I was making a good profit. I was happy back then, but now I realize that I could have made much more money if I had mined Ethereum.

Conclusion: Mine liquid coins that are easy to sell.

If you are willing to mine something new, exchange it for something decent (Bitcoin) at once or sell it for fiat money (dollars).

Mistake Four. I was greedy and careless.

Bitcoin hard forks were happening all the time. Every month there was a new fork – Bitcoin Cash, Bitcoin Gold, etc. And every time I wanted to get new coins. I was curious.

When Bitcoin Gold (BTG) was launched, there was a lot of hype around it. The launch price was $300, if I remember correctly. Everyone was looking forward to it, including myself. I wanted to see how many BTG coins I could get. I just needed to enter the private key to my wallet on the “official” Bitcoin Gold page. I entered the key. And I saw how much I would get.

Now I realize that I was such a fool, but back then I had no clue. As you might have guessed, I didn’t see bitcoins on this wallet ever again. Neither BTG, nor BTC. I was smart enough to use the empty wallet on the BTG website, but later I got a payment on it. And of course, I didn’t see it.

How much did I lose? A whole lot, much more than 1 BTC. I don’t remember exactly. I just try not to think about it.

Conclusion: Keep the private key to your wallet safe and don’t show it to anyone.

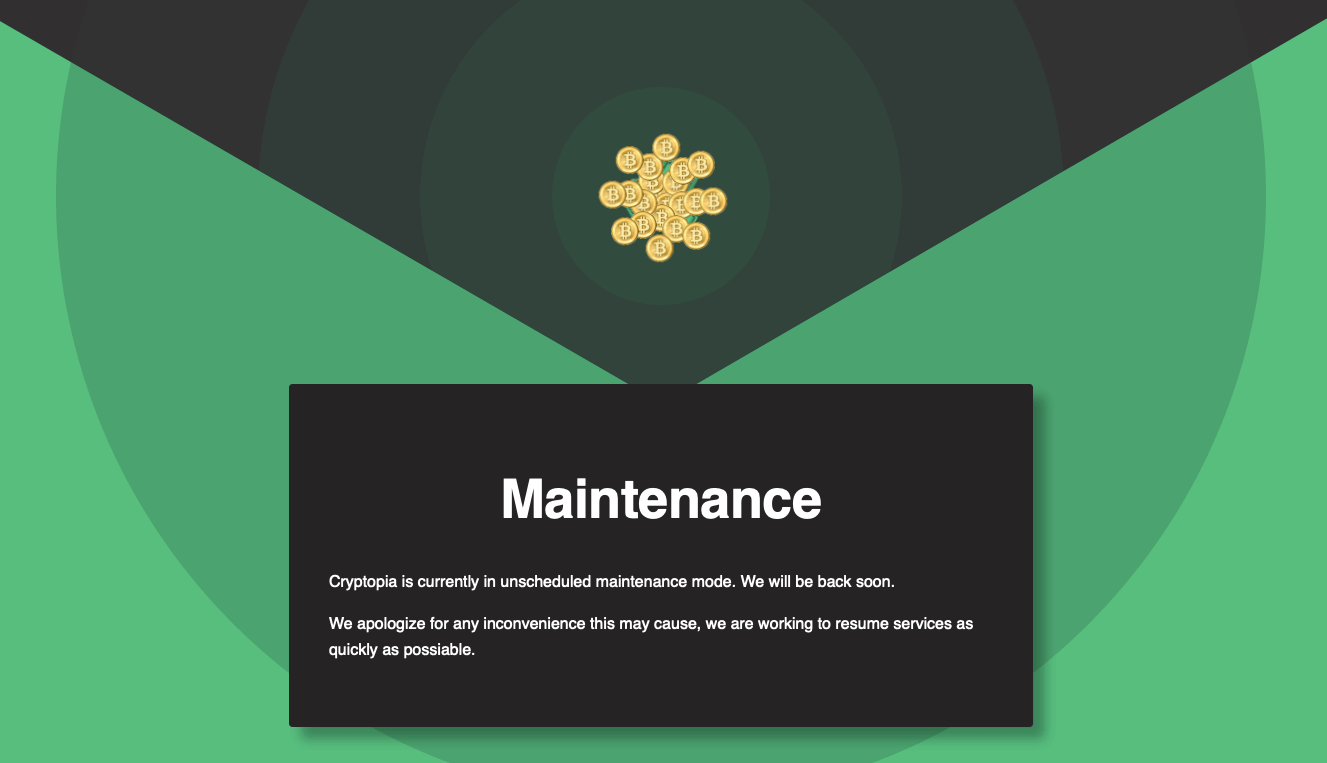

Mistake Five. I kept money on crypto exchanges.

This one is obvious. Everybody knows it, from Andreas Antonopoulos to a fifth-grader. Just don’t keep your coins on exchanges. Create a wallet, exchange cryptocurrency and transfer your coins out. This is the only possible way. An exchange may close sooner or later. It happened to a few exchanges. The case of Cryptopia was the most sensational. I didn’t lose much on this exchange, I think it was Pirl. I see that now there are still those who mine it. I wonder why.

Same thing with Nicehash. It is a platform that rents mining power. My ASICs worked through it for a while. The coins were stored on the Bitcoin wallet on Nicehash. Suddenly, Nicehash crashed. The money of all the users was stolen. The company apologized and came up with a program to compensate its clients. They compensated a little over 80%.

How much did I lose? A whole lot, around 0.5 BTC.

Conclusion: Don’t keep money on cryptocurrency exchanges.

Mistake Six. I lost control over my hardware.

I had as many as two incidents. The first one is as follows. A friend of a friend of a friend offered me to buy mining rigs in the place with cheap electricity. Not just rigs, but hosting as well. They sell you mining rigs and promise to keep them in the special room equipped for mining and maintain them. You pay only for electricity. Because I somewhat knew the seller, I decided to go for it.

For a few months it was going well, then the problems started. At times there was no electricity, then he had to move the rigs to a different place, and so on. So I told him to return my rigs. I barely managed to get back half of them.

The second incident happened in 2018. ASICs were slowly losing momentum. A friend of a friend offered to keep my rigs. I was supposed to pay $0.01 per kWh. I said yes, because the rigs were not bringing profit at my place. This time I decided to be smarter. I sent only Antminer D3 that had no value to me. Why? You’ll find out in the next chapter. I sent my ASICs and never heard from the man ever again.

Conclusion: Don’t trust anybody. This is the harsh reality of life.

Mistake Seven. I didn’t know how to choose mining hardware.

Today everybody is smart. Back then I was randomly buying ASICs available on Bitmain. Antminer D3 worked for only a month and a half. Mining difficulty increased instantly. Profitability was close to zero. Antminer A3 lasted even less. Maybe for a week. At the time when it was delivered, it had already become obsolete. I didn’t want to pay the rest of the sum for it, but as it had already arrived, I felt bad. Besides, I already paid the bigger part when placing an order.

You don’t necessarily have to buy expensive graphics cards. Nvidia 1060 and 1050Ti perform quite well, and you may also consider getting pre-owned graphics cards or mining rigs, if they can be checked. Many wanted to recoup money by selling their rigs cheaply. I had the chance to make a good deal, and I did so a couple of times.

Conclusion: Choose mining hardware wisely. Do your own calculations.

Don’t put warranty in the first place. During my years as a miner, I changed only two graphics cards on a warranty, and both were defective from the beginning. Graphics cards can work for years without maintenance.

End of Mining

Everything inevitably comes to an end. My mining business is no exception. Sadly, considering current exchange rates, an electricity price for industrial consumers in my country ($0.06–$0.07 per kWh), associated costs (a rent, equipment maintenance, the replacement of faulty parts), I barely make any profit.

I turned off my last ASICs at the beginning of 2019. Antminer S9 devices worked longer than others. Then they were just standing there. I have no idea what to do with them. For now, they are just cluttering my garage. I am trying to sell them. ASICs lost 90–95% in value, but I can’t sell them even for 5–10% of the original price. There is no demand.

I turned off my GPU rigs in January 2020. Profitability reached zero. I was surprised that I managed to sell almost all graphics cards individually at a good price. I think graphics cards lost 50% in value. So you can sell them for half of the original price. I used the cheapest motherboards, RAM and processors, so they were impossible to sell. I was lucky to sell at least some of the parts as a set for about $20.

So how much money do I have left?

As I mentioned earlier, I spent $200,000. I recovered around $150,000. I plan to sell $50,000 worth of graphics cards. I have around $40,000 in Bitcoin. I decided to hold this sum in Bitcoin and see what will happen in five or ten years. Who knows, I may buy a house somewhere in Miami one day. Or I may lose everything.

But I have nothing to worry about. I didn’t lose any money. Again, if I had been smarter, I could have easily made two times more money.

Future of Mining

The King is dead. Long live the King!

Mining is not dead. Today mining is a large-scale business run by professionals. Objectively, mining is a profitable business. But in 2017 it was profitable for everyone. In 2018 countries with expensive electricity dropped out. In 2019 everybody else dropped out. In 2020 you can mine only if you have cheap electricity. Mostly it’s China and Russia.

Everybody knows that the electricity price in Irkutsk is $0.013 per kWh. But I don’t want to go there and organize mining. It won’t work without supervision. Some put enormous rigs right next to power stations and use electricity basically for free, but we are talking about large-scale businesses. Others steal electricity, which is definitely not for me. Miners believe in karma. Bad guys don’t get blocks.

Mining from Home

What about mining from home?

Fair question. Mining from home is very much alive. In Russia, for example, the average electricity price is around $0.03–$0.04 per kWh. You can make a good profit by keeping a few rigs at home. If you build a rig using regular PSUs for desktop computers rather than server PSUs (that’s what miners often do to save money), rigs won’t make almost any noise. As if you had a regular desktop computer running 24/7. Each rig consumes 1 kWh, that is, a little less than an electric kettle. Wiring in most buildings should easily handle a few extra kilowatts. But this is not financial advice so think with your own head. If your wiring burns, it won’t be my fault. Make sure to check everything beforehand.

As for me, I could have left a few rigs at home, but honestly, I lost interest. In the past I was always in search of the most profitable coins for mining, there was always something new to explore. And what now? You just have to setup Ether mining and forget about your rigs for a year. Boring. Plus, I have a dog now, and I have no wish to remove fur from the GPU coolers every week. If nobody buys my graphics cards, I will build a rig and use it to heat my garage or my parents’ country house in winter. I’m sure it heats better than a regular radiator.

I would like to thank everyone who has made it to the end, as well as the 2Miners blog editors for letting me pour it all out and for your work. When somebody asks me about cryptocurrencies, I always share the link to your blog. I also thank the 2Miners pool itself. You have the best interface, you taught me how to mine Solo, and your Telegram chat is the best mining chat ever.